By Serena Morones, CPA, ABV, ASA, CFE

Introduction

Do you have reasonable sense about what multiple of EBITDA is appropriate to value your client’s business? Or do you toss around standard rules of thumb, without knowing what’s actually appropriate? While you may not be a business appraiser, I believe it’s possible for attorneys to develop sensible intuition about what valuation multiples serve as a reasonable estimate for the value of a business.

This article will explore some of the basic factors that drive two common valuation multiples; a multiple of EBITDA and a multiple of revenues. Exploring these factors will help attorneys gain an intuitive understanding of what multiples may be appropriate for various business types. As a business appraiser, I must issue a strong caveat: value multiples are not the only consideration when determining value. Other important factors will be mentioned later in this article. But value multiples are one of the most common ways that business owners and their advisors speak about value, and therefore attorneys would be well served to develop intuition about what drives them.

Two Common Valuation Multiples

Two of the most common value multiples spoken about by business owners are Multiple of EBITDA and a Multiple of Revenues. There are certainly many other valuation multiples used by business appraisers, and rules of thumb used within certain industries, but these two multiples seem to transcend industries and dominate business transaction language.

Here are some basic definitions necessary to begin our discussion:

Valuation Multiple: A valuation multiple is a number or factor, that when multiplied by a measure of earnings, the result equals the total capital value of a company. Examples include “2 times annual revenue,” or “6 times EBITDA.” If for example, a company earns $200,000 per year in EBITDA, a multiple of 6x EBITDA indicates a total capital value of $1.2 million.

EBIDTA: Earnings before interest, depreciation, taxes and amortization, stated on a full year basis. A method to calculate EBITDA is by starting with pre-tax profit and adding depreciation expense, amortization expense and interest expense.

Revenues: Net annual revenues of a company.

EBITDA is probably the most common measure of earnings used in the financial industry. Any legal or financial advisor should fully understand the formula and essential meaning of EBITDA. EBITDA presents a pure measure of the current earning capacity of a company, before consideration of how the company is financed (interest), how the company might be taxed (C-Corp or S-Corp) or what capital improvements or intangible asset investments might be underway that consume cash (depreciation and amortization).

What is a typical valuation multiple of EBITDA? According to our research and our business valuation practice, a commonly spoken rule of thumb for a small business (under about $5 million in revenue), before the 2008 economic crises was 5 to 6 x EBITDA. Of course many businesses could have higher or lower multiples depending on a host of factors. After the financial crisis, EBITDA multiples have gone up for some companies and substantially down for many others. A 5 to 6x rule of thumb is no longer considered to be a reliable short hand estimate of value.

Drivers of Multiples

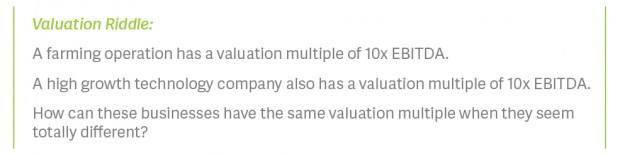

Consider this riddle: a client who owns a high growth technology company attracted an acquisition multiple of 10x EBITDA. Another client, who owns a 5th generation family farming operations insists that his business is worth 10x EBITDA. Is your farmer right? How can the farm be worth the same multiple of EBITDA as the technology company, when they are so drastically different?

We can understand the answer to this riddle if we understand the driving forces behind the multiples.

Within a multiple of EBITDA, there are two primary factors that cause variability of the multiplier: risk and growth. =

Within a multiple revenues, there are three primary drivers of variability: risk, growth and profitability.

Not to be misunderstood, these are not the only components of valuation multiples. In reality, a valuation multiple is comprised of other factors, that when added together, equal an investor’s expected return. These other components include inflation, public market levels of risk, volatility, and industry levels of debt in the capital structure. But in this author’s opinion, one can develop common sense about valuation multiples when one understands the key factors that drive the multiple upward or downward, and I believe those key factors are risk and growth for a multiple of EBITDA, and risk, growth and profitability for a multiple of revenue.

Risk

The largest factor driving a multiple of EBITDA is risk. Risk, in an investment context, describes the likelihood that expected cash flows will be received. The higher the risk, the lower the likelihood that cash flows will be received as predicted. The lower the risk, the higher the likelihood that actual future cash flows will equal expected future cash flows. Investment theory dictates that investors require a higher reward for higher risk, and require a lower reward for lower risk. Therefore, the level of risk drives the percent of annual return (or reward) that the investor requires. A simple example is that if I invest money into a risk free savings, I may earn 1% per year of interest in today’s interest rate environment. Whereas if I invest money into a venture capital fund, I expect an annual return of 30-50% because of the high risk nature of the investment. The expected total rate of return is also called a “discount rate” that an appraiser uses to calculate the today’s value of all cash flows that will be received in the future (present value). A valuation multiple is short hand way of expressing a required rate of return or a discount rate. A multiple is equal to the mathematical inverse of the discount rate, minus growth.

Risk has an inverse correlation to a value multiple. The higher the risk, the lower the value multiple, because an investor is willing to pay less for the investment in order to ensure a higher ultimate return. The lower the risk, the higher the value multiple, because the investor is willing to take a lower return.

Growth:

The second key driver of a multiple of EBITDA is growth. An investor asks the question. How much is this cash flow stream going to grow year by year into the future? Growth has a direct correlation to the multiple. The higher the expected growth, the higher the price an investor is willing to pay. The lower the growth, the lower the price the investor is willing to pay.

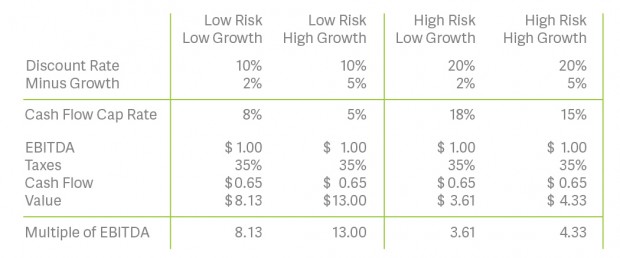

The following table illustrates multiples of EBITDA, showing the implied discount rate and growth. The discount rate reflects the level of risk; the higher the discount rate, the higher the risk and the lower the discount rate, the lower the risk.

Example EBITDA Multiples Showing Risk and Growth

Table Calculation Assumptions

- EBITDA is equal to one dollar.

- Total taxes equal to 35%.

- Depreciation and amortization equal expected cash flow used for capital expenditures.

Notice that the discount rate, which quantifies risk, has a much bigger impact on the multiple than growth. Also notice that the assumed growth rate is rather low, even in the high growth scenario. This is because the assumed growth rate represents growth in perpetuity, or forever growth. A company is not usually expected to sustain high growth forever.

Let’s answer the riddle about the high growth tech company and the farming operation. The reason both companies can have the same valuation multiple is that the very high growth of the technology company drives its multiple upward, and combined with moderate risk, commands a multiple of 10x EBITDA. The very low risk of the farming operation also drives its multiple upward to a level of 10x EBITDA.

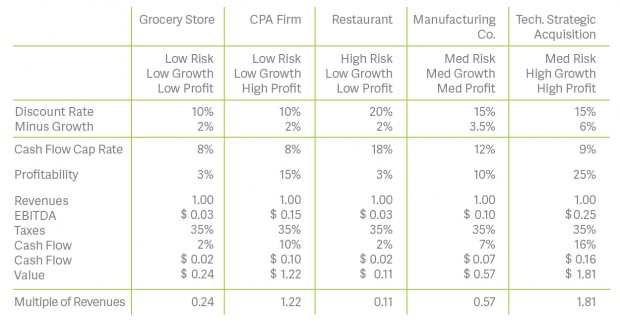

Profitability and the Multiple of Revenue:

One additional key factor drives a multiple of revenue: profitability. Profitability has a direct correlation to a multiple of revenues. A company that generates 20% profit as a percentage of sales will command a much higher multiple of revenue than a company that generates 2% profit as a percentage of sales.

I testified a few years ago in an arbitration between the founding shareholder of a twenty year old financial consulting firm and his minority shareholders. The founding shareholder had developed an unswerving expectation that he could sell his firm in a retirement buy-out for one to two times annual revenues. His expectation seemed to be based on the fact that he had invested his identify into his firm for 20 years and had successfully grown it to an impressive level of revenues. While his firm had sustained strong growth rates of 10-20% during the previous ten years, the growth was obtained at the expense of profitability. The founder had added unprofitable clients for the sake of revenue growth, believing that his eventual retirement value would be a high multiple of revenues. The bottom line profitability of this firm hovered around 2% to 5% of revenues, and cash flow was often negative because in years when the firm had to make neglected capital and technology improvements. As a result of low profitability and negative cash flow, my value opinion and the ultimate arbitration award was a small fraction of annual revenues, not the 1 to 2 times that the founder expected. The founder’s unrealistic value expectations led this company into litigation. This story illustrates that it’s critical for business owners and their advisors to understand what factors drive valuation multiples, both for the sake of creating real value, and to develop realistic expectations when it comes time to exit.

The following chart illustrates some hypothetical examples of multiples of revenue, based a variety of combinations of risk, growth and profitability.

What Else Drives Value Multiples?

Once we understand the big drivers of valuation multiples, why should a business owner ever hire an appraiser? An appraiser should be hired because there is much more that goes into a value besides a short hand application of a multiple. And often, the entire value determination is in dispute and needs a qualified professional to clearly communicate sound support for the value conclusions.

Some of the additional value considerations include:

- Normalization adjustments, such as discretionary expenses, owner compensation, or related party lease agreements

- Surplus or deficit working capital and assets

- The value impact of large capital improvements

- The amount of debt financing and the company’s ability to manage its leverage

- The value impact of erratic cash flows

- Appropriate risk assessment, given economic and industry conditions

- Allocation of value to complex capital structures, including options

Conclusion

Attorneys and their clients should gain a more intuitive understanding of the key factors that drive the variability of valuation multiples; risk, growth and profitability. If they do, they will be better equipped to develop rational value expectations that will help actually grow value, facilitate transactions and resolve disputes.

Serena Morones, CPA, ASA, ABV, CFE conducts business valuations and damage analysis for litigation in Portland, Oregon where she leads the firm Morones Analytics. Serena has testified as an expert in complex valuation cases, and has assisted many business owners in reaching a value resolution without litigation. More information about Serena can be found here.