Five Pillars of a Lost Profits Analysis

Pillar Two: Avoided Costs

by Serena Morones

Introduction

When an injured business loses revenues, that business also avoids costs required to generate those revenues. As the saying goes, “every cloud has a silver lining” and cost reduction comes along with lost revenues. These avoided costs must be deducted from lost sales to arrive at a correct measure of lost profits. However, opposing damage experts disagree on what costs to deduct and substantial time in trial can be spent arguing over what should be validly deducted.

Fixed costs are typically not deductible to arrive at lost profits. Only those direct expenses that would have been paid to generate the sales qualify as avoided expenses. Avoided costs are also commonly referred to as variable costs, meaning that when sales increase these expenses increase and vice versa. In this article we discuss how to identify avoided costs.

Identification of Avoided Costs

Experts can use a variety of methods to support the identification of avoided costs and should not choose avoided costs based on unsupported opinion. The most common steps to identify avoided costs include reviewing the financial statement’s cost categories for variable-type cost descriptions, conducting regression analysis using revenue and expense data, interviewing witnesses or reading deposition testimony and reviewing documents to identify costs that must be variable due to financial arrangements, such as a commission rate or incentive bonus.

Income Statement Review

The most common way experts identify variable costs is to read the expense account descriptions on an income statement, trial balance or chart of accounts and identify cost categories that are likely to be variable. Potential variable cost categories include:

- Sales allowances

- Cost of sales-primarily material

- Distribution expense

- Commissions

- Credit card service fees

It’s important to note that not every expense that an expert believes should be variable, will in fact be variable, therefore an expert should consider additional inquiry and analysis. For example, an expert may assume that commissions would be variable, but sometimes commissions include minimum compensation levels such that the loss of marginal revenues would not reduce amounts paid to sales people. Several cost categories may include a combination of fixed and variable components and the expert should not simply assume an expense is variable without analyzing the behavior of the expense to draw out the variable portion.

Examples of costs that may include fixed and variable components include:

- Labor

- Utilities

- Promotional expense based on sales volume.

- Supplies

- Maintenance and repair

Regression Analysis

Experts may employ regression analysis, a complex mathematical formula, to identify the categories and amounts of costs that change in direct correlation to changes in revenues. While the regression math is quite complex, regression analysis can be conducted using Excel spreadsheet functions. In order to use regression analysis, the expert should have both sales data (x) and cost data (y) for the same number of periods (the more periods the better).

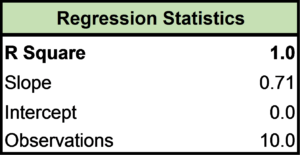

Regression analysis provides a key statistic called R-Squared, that quantifies the degree of correlation between two data sets; the independent variable (x) and the dependent variable (y). An R-Squared of 1.0 indicates perfect correlation between x and y. An R-Squared higher than 0.5 indicates a reasonable level of correlation. An R-Squared of less than 0.5 indicates that the set of y data is insufficiently correlated to the set of x data, and therefore, the y data likely does not represent a variable cost category.

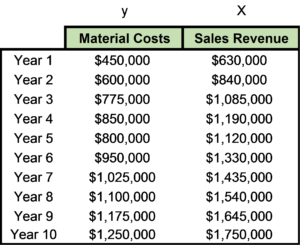

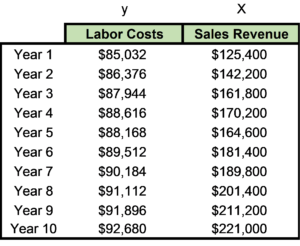

The following data showing material costs (y) and sales revenue (x), illustrates a perfectly correlated set of data, indicating that material costs are direct variable costs of sales, and include no fixed costs.

In a regression analysis, the slope indicates the steepness of a regression line, while the intercept indicates the location where it intersects the y axis. If material costs and sales revenue data sets are highly correlated, the slope quantifies the ratio (or percentage) of variable costs to sales, while the intercept represents the amount of fixed costs included in the y data points.

In the above data set, the ratio of material costs to sales is 71%. Therefore, in a lost profits analysis, the damage expert should deduct 71% of sales as a variable (or avoided) cost of materials.

Most often, expense data includes both fixed and variable components. The following data set illustrates labor costs and revenue, where the labor costs contain a fixed component of $75,000 per year as well as a variable component of 8% of revenues. Such labor data could represent costs that include salaried employees (fixed costs) as well as temporary employees whose costs increase and decrease according to sales volume. In this illustration, the damage expert should deduct the variable component, or 8% of sales, as an avoided cost.

In practice, use of regression can be overly complex and problematic, such as too few data points or inconsistent accounting information.

Interviewing Witnesses/Deposition Testimony

Another method an expert can use to identify variable costs includes interviewing witnesses and reading deposition testimony. For example, marketing expenses may have contractual ties to revenues, such as customer marketing allowances, or they may be fixed expenses because marketing budgets are set at the beginning of a budget period and are not influenced by actual sales. Witness interviews or deposition testimony help identify variable cost categories that may not be apparent by reviewing financials or regression analysis.

Document Review

Finally, an expert should review documents to identify any records that explain the nature of expenses. For example, a company may have employment contracts that specify the fixed and variable portion of a sales person’s compensation. The expert can rely on such a document to accurately break out sales compensation expense between its fixed and variable components.

Conclusion

The damage expert should not choose expenses to deduct from lost sales based on unsupported opinion alone but should use any of the above methods available in a specific matter to construct a reasonable basis for deducted expenses.