Case Study: Financial Analysis Finds No Commingling of Cargo Vessel Holding Companies

By Serena Morones and Jennifer Prager

Issue:

The plaintiff, a cargo broker, sought to pierce the corporate veil of a vessel holding company and hold related entities financially responsible for cargo losses caused by the grounding of a vessel owned by one of the defendant entities. The plaintiff claimed that the defendant entities were commingling funds and should therefore be jointly liable for the cargo losses.

Assignment:

Our role was to evaluate the voluminous financial records of the four defendant entities, related companies involved in the global shipping industry, and determine whether the defendant ship manager engaged in commingling of funds or self-dealing transactions. The ship manager maintained one global general ledger for all companies it managed, and the defendant entities had some common ownership.

Resolution:

We set out our own definition of commingling based on our years of experience as forensic accountants, having seen numerous examples of commingling. We defined commingling as follows:

Commingling is a practice of failing to keep company funds separate by mixing funds belonging to one entity or individual, with another entity or individual, to a degree where the separate identity of funds cannot be readily determined. Examples of commingling can include a shareholder paying substantial personal expenses with corporate funds without proper accounting and repayment, an owner or manager transferring funds from one entity to another to meet cash flow needs, or one entity paying the business expenses of another entity without a clear business purpose for doing so, without maintaining a proper accounting.

Given the high volume of transactions, we evaluated all transactions and intercompany balances between the related companies at issue using our advanced data analytics tools. We determined that the ship manager kept separate books and records for each entity and maintained separate bank accounts. Some services were provided by the ship manager, and management costs and other shared costs were properly allocated to the vessel entities. We determined that careful records had been maintained that respected the funds of each entity, separating income, expenses, assets and liabilities.

We also considered the potential for self-dealing by evaluating all transactions between the entities and the individual managers and found that adequate records were kept quantifying the nature and accounting classification of the transactions with the controlling individuals.

We concluded that we found no evidence of commingling or self-dealing. The case concluded on summary judgment, as the judge adopted our findings and ruled that the plaintiff did not provide sufficient evidence of commingling.

—————————————————

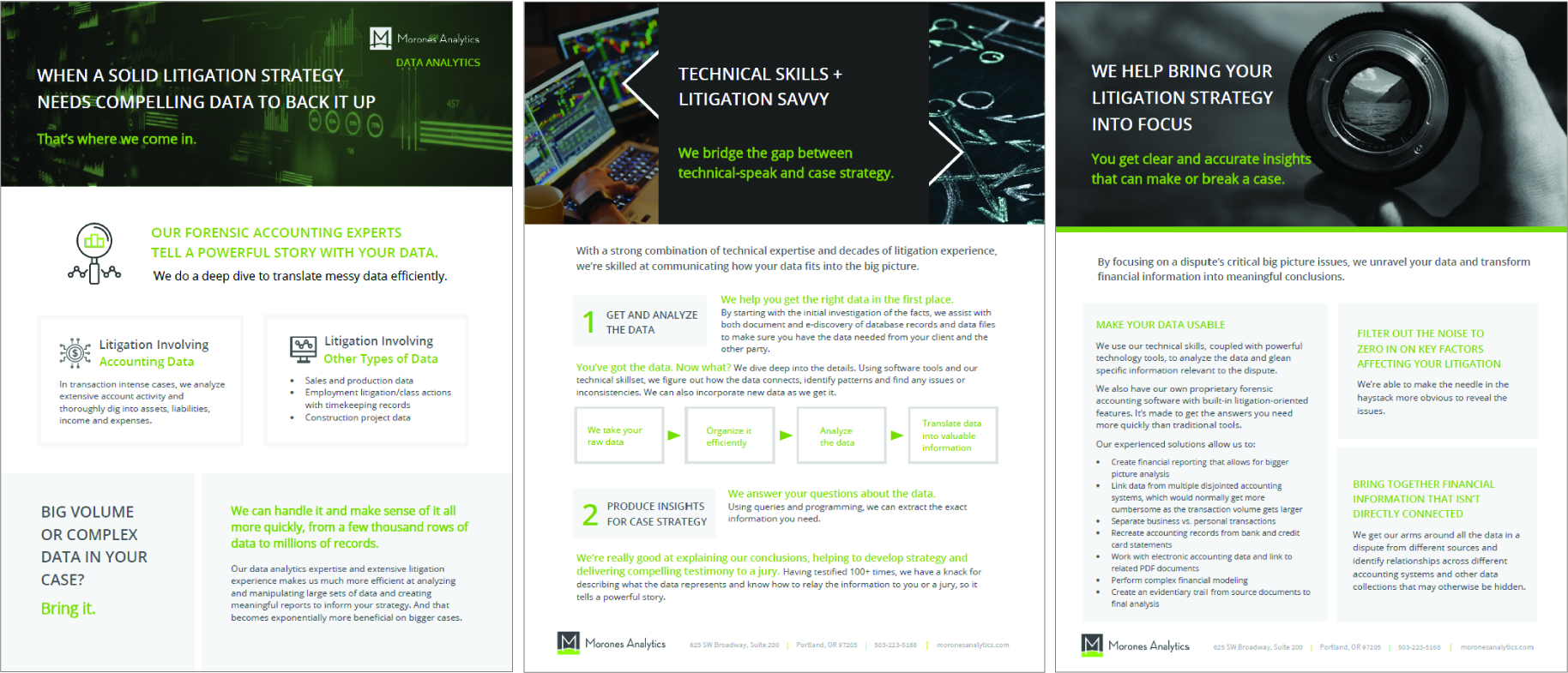

Learn more about our Data Analytics tools and services: