By Serena Morones, CPA, ASA, ABV, CFE

When the time comes for partners to separate, they must true up the partnership books and calculate an amount that will be paid to one or more partners. During the life of the partnership, one or more partners may have paid partnership expenses with personal funds and never sought a proper accounting for those expenditures until a dispute arose.

All partnership expenses incurred outside of regular partnership accounts must be identified and correctly recorded before a final financial resolution can be determined. Sometimes professional advisors believe that the resolution of these expenses is to simply adjust the final number up or down by the amount of these expenses. However, this simple adjustment is often made incorrectly, as I will illustrate below.

What is the proper accounting treatment for valid business expenses paid personally by a partner?

Let’s hypothetically assume that Partner Jones is a 25% partner and spends $500 of his own money to buy office supplies for the partnership.

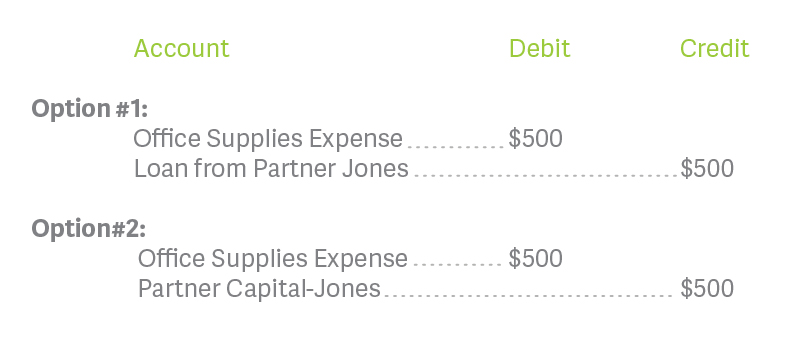

There are two options to properly account for Partner Jones’ expenditures. One option is to treat the expenses as a loan from Partner Jones to the partnership. The other option is to treat the expenses as a capital contribution by Jones to the partnership. Journal entries for the two options are as follows:

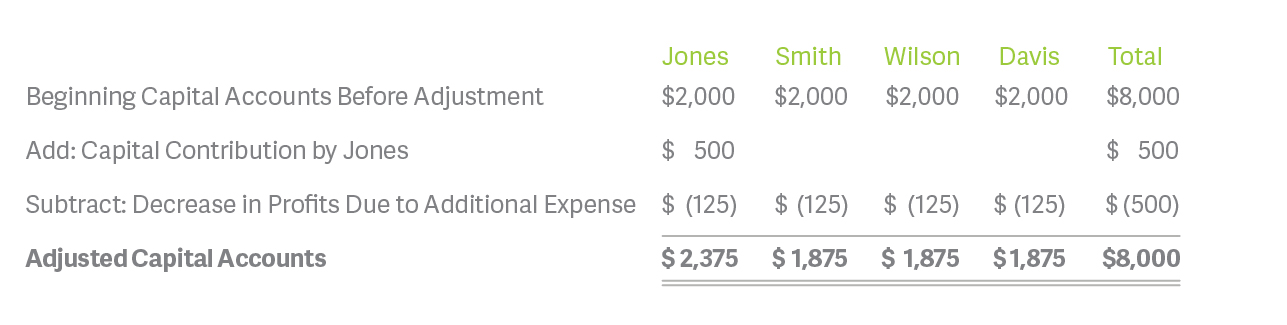

The net effect to Partner Jones is not a repayment of $500, as many would expect.

It would be a mistake to assume that the remaining partners owe Partner Jones a repayment of $500. Instead, Partner Jones must also be allocated his proportionate share of the impact of the $500 expense on profits. As a result, his capital account is also reduced by his 25% share of $500.

I have seen this error made in a dispute resolution context, typically due to the fact that these expenses were never actually entered into the books when they were incurred. The professional advisors erroneously believed the partnership should simply repay the amounts advanced by the partner.

The actual net effect of this hypothetical transaction to Partner Jones is that the partnership owes Partner Jones only $375 for incurring $500 of expenses on behalf of the partnership, as illustrated in the capital account analysis below.

The same result to Partner Jones would occur if the $500 of expenses had been accounted for as a loan by Partner Jones, not a capital contribution. The partnership would owe Partner Jones $500; however Partner Jones’ capital account would decline by $125, netting to $375 owed to Jones.

The fourth article in this series, “Identifying and Adjusting Personal Expenses” provides guidance on how to classify an expense as business or personal, and sets forth what is adequate documentation to support a business expense. Article Four should be read in conjunction with this article to guide in evaluating whether or not the expenses incurred by the partner are legitimately business related.

Please email me at [email protected] with any feedback or suggestions for topic areas that you think I should cover in this series.

Serena Morones, CPA, ASA, ABV, CFE