Guard Rails That Lead to Expert Credibility in Litigation

By Terry Whitehead, CPA, ASA, ABV

What is an expert’s secret for attaining credibility on the witness stand? The not-so-secret answer is to follow professional standards and guidelines. In this piece, we cover what every litigator needs to know about standards that lead to expert credibility.

Business appraisers and financial experts, including certified public accountants (CPAs), are subject to various rules, standards, and code of conduct guidelines. When serving as an expert witness in Federal disputes, these professionals need to also abide by specific requirements under Rule 702.[1] Adherence to these rules and standards provides a framework for experts to arrive at a credible opinion. An expert analysis that does not follow required rules and standards may be perceived as unreliable.

Guidance Experts Should Live By

In 2003, the American Institute of Certified Public Accountants (AICPA) published: Litigation Services and Applicable Professional Standards (Special Report).[2] The purpose was “…to provide practitioners with additional guidance on the existing professional standards and the related responsibilities that affect the litigation services practitioner.”[3]

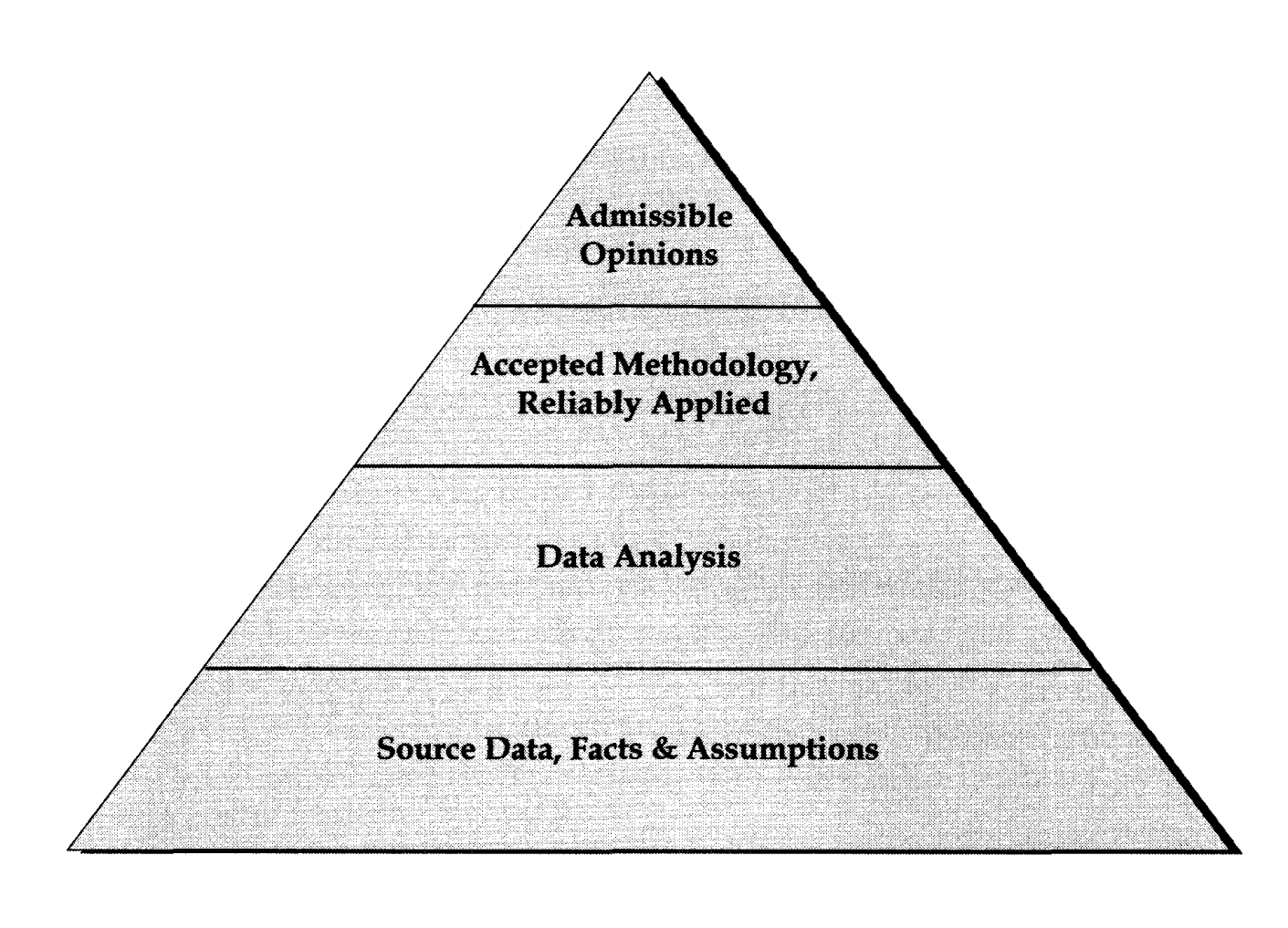

The Special Report emphasized that “…expert testimony be based upon sufficient facts or data, be the product of reliable principles and methods, and that the principles and methods be reliably applied to the facts of the case.”[4] The AICPA report also displayed a “testimony pyramid” graphically illustrating the necessary foundational levels to produce an admissible opinion.

AICPA Code of Professional Conduct

The AICPA Statement on Standards for Forensic Services No. 1 (SSFS No. 1) requires that CPA forensic accountants comply with the AICPA Code of Professional Conduct[5] (“Code of Conduct”), including the following:

- Due professional care. Exercise due professional care in the performance of professional services.

- Sufficient relevant data. Obtain sufficient relevant data to afford a reasonable basis for conclusions or recommendations in relation to any professional services performed.

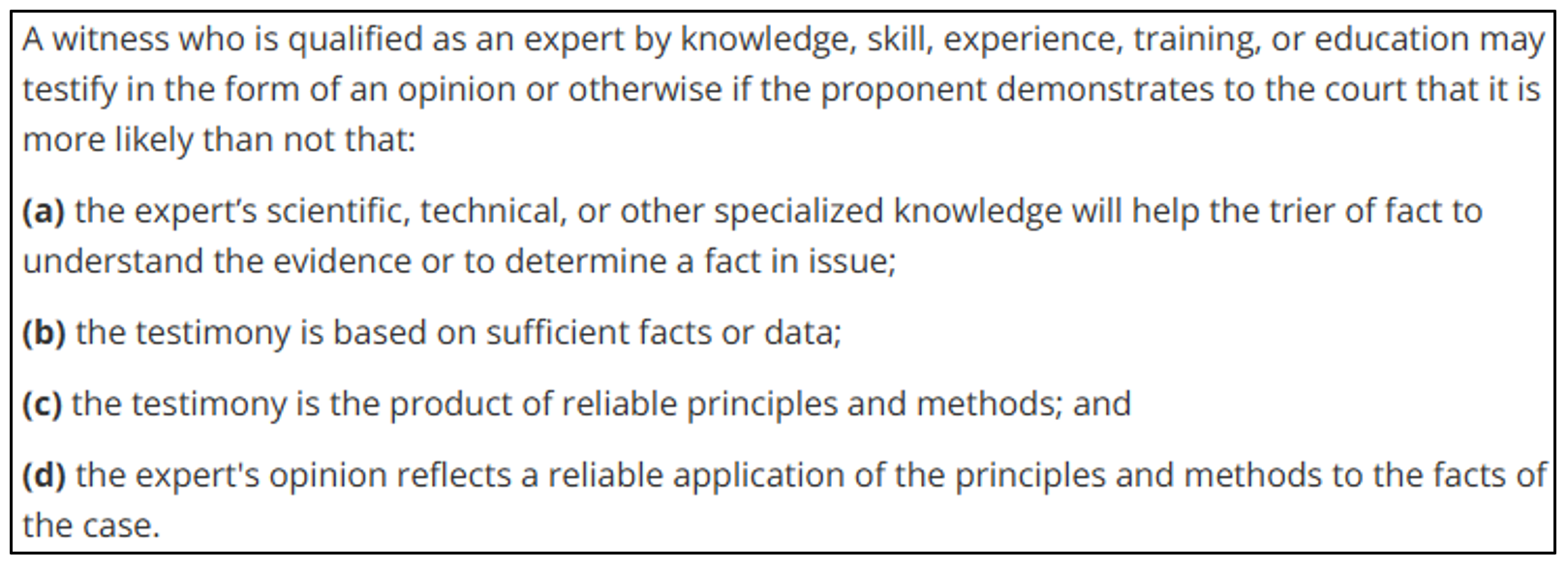

Federal Rules of Evidence

Rule 702 identifies specific requirements for expert witness testimony defined as follows.

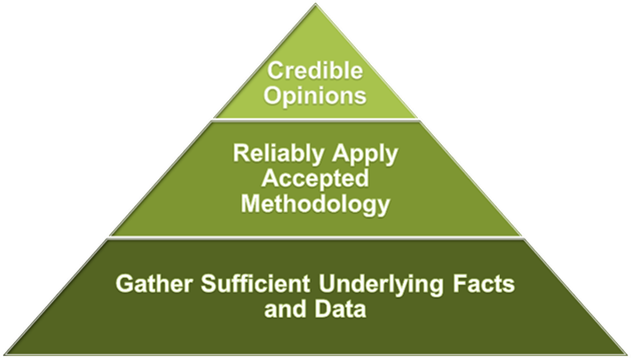

The Credible Opinion Hierarchy

Our firm implements the AICPA Code of Conduct and Rule 702 into our opinion development process with what we describe as a Credible Opinion Hierarchy. This pyramid illustrates the primary foundations needed for a business appraiser or damage expert witness to produce a credible opinion.

Gather Sufficient Underlying Facts and Data

Information or assumptions provided by company management or the client in a litigation matter is an example of gathering underlying facts. When provided assumptions are of a financial or accounting nature, the CPA damage expert should seek and obtain adequate support for assumptions provided by clients. In addition to merely gathering data and evidence, it may be necessary for a CPA damage expert to conduct independent analysis to demonstrate the reliability of the assumption provided. Otherwise, the expert will face effective rebuttal when facing contradictory evidence or analysis showing the assumption is not reliable.

Reliably Apply Accepted Methodology

Business appraisers and financial experts should use generally accepted methodologies in valuations or damage analysis. Although the facts and circumstances in a particular matter may require an unconventional approach, reliability of an uncommon approach may be more difficult to establish.

An example of accepted methodology in the business valuation context includes application of the three approaches to business valuation, the income approach, the market approach, and the asset approach. Within each approach, there are multiple accepted methods. However, it is likely that one approach or method may be more relevant than another.

The Uniform Standard of Professional Appraisal Practice (USPAP) includes development and reporting standards in business appraisals for its members. Standards Rule 9-1 (General Development Requirements) of USPAP includes the following requirements for business appraisal.

In developing an appraisal of an interest in a business enterprise or intangible asset, an appraiser must:

- be aware of, understand, and correctly employ those recognized approaches, methods, and procedures that are necessary to produce credible appraisal;

- not commit a substantial error of omission or commission that significantly affects an appraisal; and

- not render appraisal services in a careless or negligent manner, such as by making a series of errors that, although individually might not significantly affect the results of an appraisal, in the aggregate affect the credibility of those results.

Bottom Line: Expert Credibility Can Make or Break Your Case

At first glance, the financial analysis provided by a CPA expert witness may appear complex and complete. However, upon intense scrutiny from opposing experts, the analysis may crumble due to underlying lack of credibility. In litigation involving competing expert opinions, credibility is more crucial than the complexity of the analysis itself.

In 2025, a judge provided commentary on Terry Whitehead’s testimony in a shareholder oppression case:

“The most credible evidence offered in this case is from plaintiffs as to fair value. Plaintiffs’ expert provided a detailed and thorough analysis in presenting multiple approaches in valuing (company). His testimony was detailed and demonstrated a clear grasp of the financial issues, income streams and assets of the company.”

[1] Federal Rules of Evidence, Rule 702, 28 U.S.C.A.

[2] Litigation Services and Applicable Professional Standards; Consulting Services Special Report, 03-1, AICPA, 2003.

[3] Special Report, page 1.

[4] Special Report, page 19.

[5] General Standards Rule Sec. 1.300.001 and 2.300.001 (excerpted from SSFS No. 1).

******************

Terry G. Whitehead, CPA, ASA, ABV brings 25+ years of experience providing business valuations, financial analysis, and lost profits damage analysis for businesses and individuals covering a broad range of industries.

210-725-8646 | [email protected]