Three Key Things to Know About Business Valuation of Multi-Tiered Entities

Having valued several multi-tiered entity organizations with complex ownership structures over the years, we are presenting a brief overview of the multi-tiered entity valuation process and considerations, common documents needed, and potential valuation discounts that may apply.

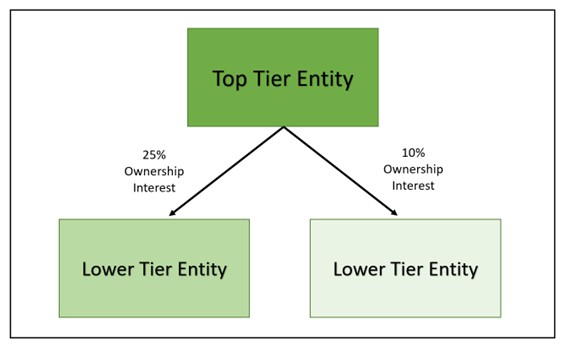

A multi-tiered entity is defined as a company (the “top-tier” entity) that owns an interest in another company (the “lower-tier” entity) and is often in the form of asset-holding companies owning real property. Their valuation is typically performed for various tax-related reporting or planning purposes.

1. Valuation Process, Considerations and Asset-Based Approach

When valuing a multi-tiered entity, an appraiser is not only tasked with determining the value of the top-tier entity but must also estimate the value of any related ownership interests in affiliated lower-tier entities. We have valued several multi-tiered entities that involved as many as 10 different entities and four lower tiers. These entities often hold more than a single piece of property and sometimes more than 15 individual property holdings, with each entity and real estate property requiring separate analysis and valuation. Obviously, as the number of entities and assets increases, so does the complexity of the valuation.

We are not real estate appraisers, so we typically rely on a client engaging a qualified real estate appraiser to provide an opinion of value for the subject properties.

As an example, if the top-tier entity owns a 25% ownership interest in a separate lower-tier entity and a 10% ownership interest in another separate lower-tier entity, both the 25% and 10% ownership interests in the lower-tier entities will need to be considered to determine the total value of the top-tier entity. Additionally, if the lower-tier entities have further ownership interests in other lower-tier entities, those additional investments would also require valuation consideration.

As an example, if the top-tier entity owns a 25% ownership interest in a separate lower-tier entity and a 10% ownership interest in another separate lower-tier entity, both the 25% and 10% ownership interests in the lower-tier entities will need to be considered to determine the total value of the top-tier entity. Additionally, if the lower-tier entities have further ownership interests in other lower-tier entities, those additional investments would also require valuation consideration.

The Asset-Based Approach is often the primary approach when valuing a multi-tier entity organization that mainly consists of asset-holding companies. An entity’s net asset value is estimated by adjusting the value of assets and liabilities from the reported historical cost or book value to an estimated market value indication. This process typically entails restating the book value of an entity’s real property and/or investments in other entities to their market value as of the valuation date.

2. Common Documents Needed

Given the often-complex structure of a multi-tiered entity organization, it is important to properly identify the scope of the engagement. Before estimating the professional fees to complete an engagement, we typically request a summary of the multi-tiered entity structure, including the number of entities involved, the ownership structure of each entity, and the types of assets owned by each entity (i.e., cash, marketable securities or other investments, land, real estate, ownership interests in other entities, etc.).

Once engaged, we typically request the following documents for the top-tier entity and all applicable lower-tier entities:

- Governing Documents. These typically include articles of incorporation, company bylaws, or operating agreements and are used to identify the rights and restrictions of an ownership interest in an entity that may be relevant to assist in determining applicable valuation discounts.

- Shareholders. A list of shareholder names and their respective ownership as of the valuation date.

- Financial Statements. Historical income statements and balance sheets (typically five years) often derived from tax returns or the company’s internal accounting system. A balance sheet as of the valuation date is vitally important for the valuation of an asset-holding company, as it is an initial representation of the assets an entity owns.

- Real Property Values. As indicated previously, we are not real estate appraisers and would need appraisals from a qualified real estate appraiser or other reliable indication of value for any real estate owned by an entity.

3. Potential Valuation Discounts

Valuation discounts should consider the facts and circumstances of the entity and ownership interest, which may include:

(1) underlying risk factors of the assets held by the multi-tiered entity (asset diversification, liquidity time horizon, etc.);

(2) contractual restrictions of the various ownership interests (control and management of the operations, determination of distributions, transferability of shares, ability to liquidate or withdraw, etc.).

Valuation discounts considered for the valuation of an ownership interest in a multi-tiered entity typically include:

- A discount for lack of control, which quantifies the reduction in value of an investment due to a non-controlling shareholder’s lack of ability to exercise control over the entity.

- A discount for lack of marketability, which quantifies the disadvantage of owning an illiquid investment without a ready market to convert the investment to cash.

In addition to the discounts for lack of control and marketability, there may be additional valuation considerations related to the impact on value of a multi-tier entity ownership structure. The economic effect of being potentially twice removed from the management of the assets themselves may make the ownership interest being valued a less attractive investment and, therefore, subject to additional valuation considerations. Also, differences in owners at each tier can create additional uncertainty or other operational risk.

As the pool of potential buyers who wish to accept all the unique characteristics of the multi-tiered entity structure is diminished, the reduction in value of an ownership interest may be substantial to reflect the underlying lack of control, lack of marketability, and other multi-tier considerations of the investment.

Paul Heidt is the Director of Valuation Research for Morones Analytics. He has substantial experience valuing closely-held businesses for litigation, gift and estate tax planning, marital dissolution, business transactions, reorganizations, and succession planning.

To learn more about potentially valuing your business, contact Paul Heidt at 503-906-1583 or [email protected].