Why Owning 10% of a Business

Doesn’t Mean You Get 10% of Its Value:

Calculating Valuation Discounts for Minority Interests

By Alina Niculita, ASA, CFA, ARM-BV, MBA

Business owners are often surprised by a fact that is well known in the business valuation world: a 10% stake in your company may not be worth 10% of its value. This is the case because of valuation discounts that are taken from the pro-rata share of business value.

If you’re considering selling or gifting a minority stake in a business, you should be aware of how this applies to you. See our short example on the application of these discounts and discussion on why discounts for lack of control and lack of marketability exist.

Minority interest business valuation example

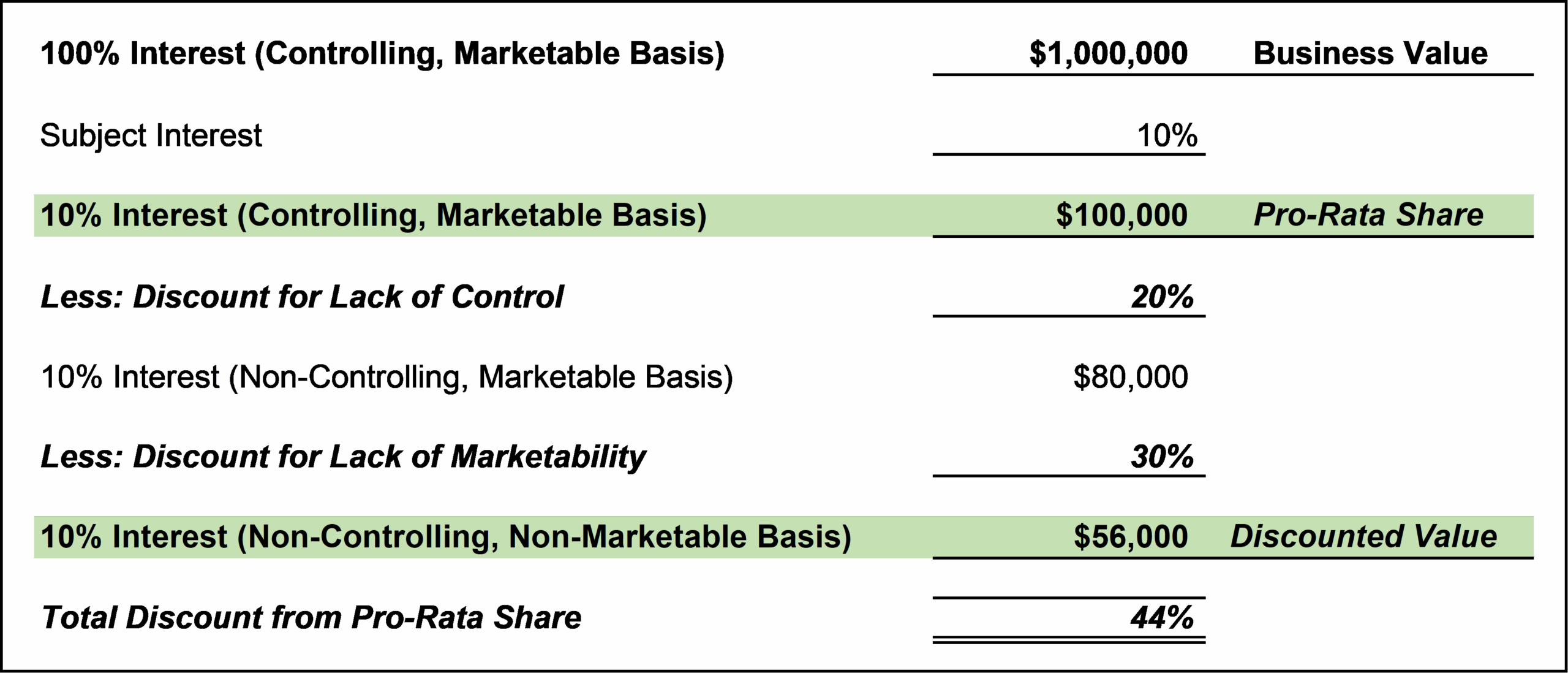

Assume you own 10% of a $1 million company. On paper, that looks like $100,000, but in reality, the lack of control and the difficulty in selling your shares can reduce that value to just $56,000.[1]

Below is a hypothetical example of a minority interest valuation starting from the 100% controlling value.

In the table above, we start with the value of 100% controlling interest in the business, which in this hypothetical example is $1,000,000. The pro-rata share of our 10% interest is $100,000. This is what business owners would incorrectly assume is the value of their interest. But fair market value in business valuation typically assumes valuation discounts.

In this example, we apply a discount for lack of control of 20% and a discount for lack of marketability of 30%.[2] The final discounted value of the 10% interest is $56,000, a 44% discount from the pro-rata share value of $100,000.

Why do valuation discounts exist?

A minority interest in a business does not give its owner controlling rights such as access to the cash and assets of the business, the right to declare distributions, and to hire and fire management. A minority interest is also not readily marketable, as there is no market where to sell your interest in a privately held business.

Because of these deficiencies, under a fair market value standard, a willing buyer would request, and a willing seller would grant, discounts for lack of control and lack of marketability. It would not be uncommon to have discounts of 30%-40% or more for small minority interests in privately held companies.

Fair Market Value is defined as:

“A Standard of Value considered to represent the price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, each acting at arms-length in an open and unrestricted market, when neither is under compulsion to buy or to sell and when both have reasonable knowledge of relevant facts.”[3]

Discount for lack of control

When a buyer acquires a controlling interest in a business (typically over 50% interest), the buyer receives all the control rights in the business, also called prerogatives of control. These prerogatives of control include among others:[4]

1. Select the company’s directors, officers, and employees.

2. Determine compensation and benefits/perquisites for directors, officers, and employees.

3. Determine operational and strategic policy including the direction of the business.

4. Buy, sell, lease, or hypothecate company assets.

5. Select those with whom to do business and enter into binding contracts.

6. Consummate mergers, acquisitions, and divestitures.

7. Sell a controlling interest in the company, with or without participation by the non-controlling owners.

8. Change the capital structure.

9. Register the company’s stock or debt for public offering.

10. Determine the amount and timing of dividends/distributions.

11. Amend many governing documents.

12. Block any of the above actions.

Minority or non-controlling business interests, on the other hand, do not contain these prerogatives of control. As a result, they will be less valuable on a pro-rata basis than controlling interests.

Discount for lack of marketability

Everything else equal, an ownership interest in a business is more valuable if it is readily marketable. Marketability is defined as:[5]

“The ability to quickly or readily convert an asset, business, or investment to cash at minimal cost that reflects the capability and ease of transfer or salability of that property. Marketability is affected by, among other things, the particular market in which the asset is expected to transact and the characteristics of the asset.”

Minority interests in private businesses are difficult to sell because no ready market exists. A hypothetical seller would have to expend significant effort and expense to locate a buyer and consummate a transaction. A hypothetical buyer would have to conduct due diligence. Because of the lack of marketability of minority interests in closely held businesses, a discount for lack of marketability is applied to a value indication that assumes full marketability.

Discount for lack of marketability is defined as:

“An amount or percentage applied to the value of an ownership interest to reflect as relative lack of marketability.”[6]

Bottom Line

A minority, or non-controlling, interest in a business is less valuable under a fair market value standard than its pro-rata share of the total value because of valuation discounts such as lack of control and lack of marketability.

For business owners, and their wealth planning advisors, understanding these discounts is critical when planning ownership transfers, succession, or shareholder exits. If you’re considering selling or gifting a minority stake, get in touch with us for a professional valuation which can help you understand its true fair market value.

[1] Hypothetical example is meant for illustration purposes; it does not reflect the discounts that may exist in a specific situation.

[2] These are hypothetical discounts, the levels of discounts in a specific case depends on the specific facts and circumstances.

[3] The International Valuation Glossary – Business Valuation. https://www.appraisers.org/about/standards-ethics-and-policies/standards.

[4] Shannon Pratt’s Valuing a Business, 6th edition, page 391.

[5] The International Valuation Glossary – Business Valuation. https://www.appraisers.org/about/standards-ethics-and-policies/standards.

[6] Ibid.

Want more on business valuation? See our previous articles:

Business Valuation Nuts & Bolts – See clips from our webinar

Fuel in the Tank: Why Working Capital Powers Business Value but Can Easily Kill a Deal

4 Strategic Benefits of an Annual Business Valuation

Answering Common Questions from Clients: My Business Partner Wants Out. How Much Should I Pay Them?

Answering Common Questions from Clients: What is the Value of My Business?

Answers to Top 3 Questions on Business Valuation Approaches

Answers to Attorney FAQs on Preferred Business Valuation Methods.

————————————————–

Alina Niculita, ASA, CFA, ARM-BV, MBA is a valuation and testifying expert who has specialized in business appraisal and appraisal review for litigation cases and business transactions for two decades. She has appraised hundreds of companies in diverse industries and sizes up to several billion dollars in revenue and testified in support of her opinions.

Alina Niculita, ASA, CFA, ARM-BV, MBA is a valuation and testifying expert who has specialized in business appraisal and appraisal review for litigation cases and business transactions for two decades. She has appraised hundreds of companies in diverse industries and sizes up to several billion dollars in revenue and testified in support of her opinions.

503-906-1585 | [email protected]