Financial Resolution of Partnership Disputes

Article 3: Accounting for Partner Services

By Serena Morones, CPA, ASA, ABV, CFE

Accounting for partner services is unique to partnerships and unlike issues of owner compensation in corporations. As a general rule, partners are not entitled to compensation for services rendered to the partnership, unless the partners specifically agree to compensate partners.[1] Because partnerships can be casually or unknowingly formed, partners often don’t document an agreement about how to pay themselves for services rendered to the partnership, leaving the partners at risk of dispute. Partners also commonly agree to exchange services for their interests in a partnership, but don’t know how to account for such agreements when the time comes to unwind partnership business affairs. This article will describe proper accounting for a partner’s service on behalf of a partnership.

General Rule: No Partner Compensation

The general rule prescribed by the Revised Uniform Partnership Act (RUPA) is that “(a) partner is not entitled to remuneration for services performed for the partnership, except for reasonable compensation for services rendered in winding up the business of the partnership.”[2] A common partnership scenario involves two or more individuals agreeing to expend effort in order to generate a profit. Under the RUPA rule mentioned above, the agreed profit sharing ratio amongst the partners represents the entire remuneration to the partners for effort expended on behalf of the partnership.

Therefore, unless the partners agreed to terms of compensation for services, a partnership accounting and final financial resolution should not include payment for services rendered by a partner.

Services Rendered In Exchange for a Partnership Interest

Sometimes a partner will negotiate the right to own a profit sharing interest, a capital interest, or both in exchange for services rendered (a service exchange transaction). The correct accounting treatment for a service exchange transaction is essential to a financial resolution because service exchange transactions impact all partners’ capital accounts. Determining correct capital accounts is essential to reaching a financial resolution of a partnership dispute as discussed more fully in Article 2 of this series. The correct accounting for service exchange transactions depends on whether the services are performed in exchange for a profit sharing interest or a capital interest.

If services are exchanged for a profit sharing interest only, there is no specific accounting required upon formation of the partnership. When profits or losses are generated, the profits or losses are credited or debited, respectively, to the service partner’s capital account[3] according to the agreed profit sharing ratio.

When services are exchanged for a capital interest, the service partner must recognize ordinary taxable income equal to the value of the capital account received and the partnership must credit the service partner’s capital account in an amount equal to the value of the capital account that the service partner will own upon formation. The value of the capital account received by the service partner depends on whether or not the services resulted in the addition of a capital asset or not.

If the partner’s contribution of services results in the creation of an asset for the partnership, such as the creation of a company website, the value of the asset must be debit to the partnership books and a credit made to the service partner’s capital account, representing the value of his capital contribution. A second entry may need to be made to adjust all the partner’s capital accounts to the agreed capital sharing ratio.

If the partner’s contribution of services does not result in the creation of an asset, the partnership credits the service partner’s capital account for his pro-rata value of the total capital, and debits the non service partners’ capital accounts for the value of capital shifted from the non-service partners to the service partner.

The following hypothetical examples illustrate the proper accounting treatment under two scenarios where services are exchanged for a capital interest in a partnership.

Services Exchanged for Capital Interest – Hypothetical Examples

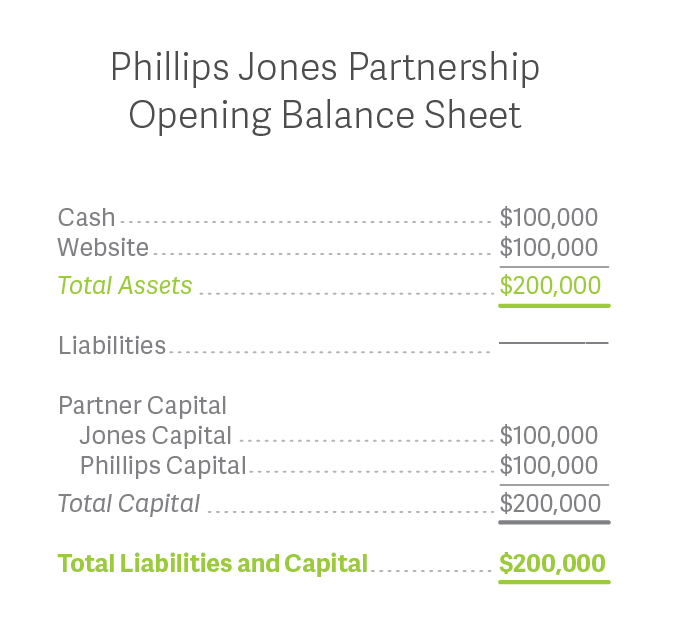

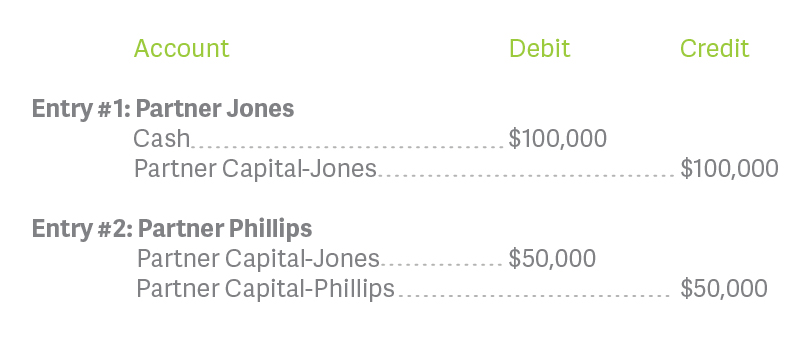

Partner Phillips develops a website in exchange for a 50% profit and capital interest in Phillips Jones Partnership. The partnership will operate an e-commerce tax advice website. Partner Jones will contribute $100,000 of cash to fund working capital and other start-up expenses. The value of the e-commerce website is assumed to be a capital asset also worth $100,000. What is the proper accounting treatment by the partnership and what are the partner capital account balances upon formation, assuming the website is finished and contributed upon formation?

In the above example, the services rendered resulted in a capital asset. Also, Partner Phillips must individually recognize $100,000 of ordinary income for having performed services in exchange for his partnership interest worth $100,000.

The opening balance sheet of the partnership would look like this:

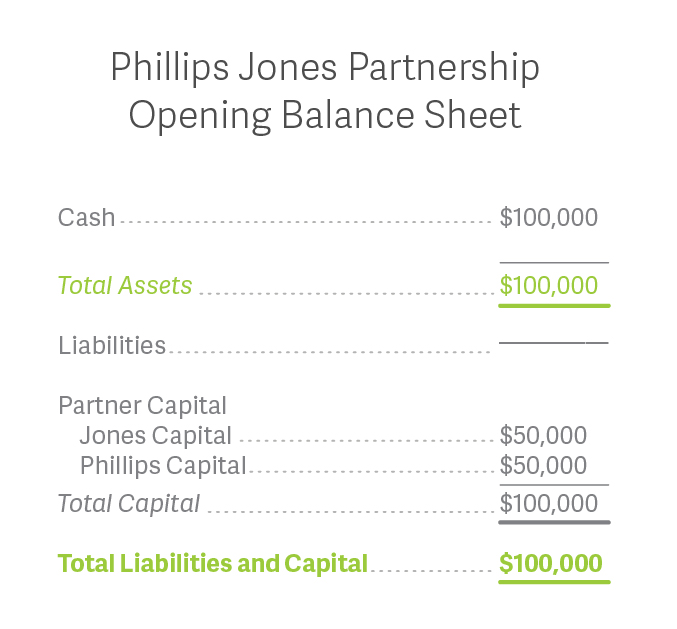

What would be the correct accounting if the services provided do not result in a capital asset of the partnership? Assume that Partner Phillips agrees to spend time networking and gaining potential clients prior to formation, in exchange for a 50% profit and capital interest. In this second scenario, the partnership credits partner Phillips’ capital account with the value of the partnership capital he receives, and debits Partner Jones’ capital account by the value of the capital transferred to Phillips. Partner Phillips individually recognizes $50,000 of ordinary income on his tax return.

The opening partnership balance sheet for the second scenario is as follows:

There are many variations of agreements that involve partners trading services for a partnership interest, in the form of either in a profit or capital interest. The simple examples above illustrate proper accounting and the effect on partner capital accounts when services are exchanged for a partnership interest.

Guaranteed Payments to Partners

Many partnerships agree to compensate a partner for specific services performed, such as for professional services offered to clients or administration of the partnership. Regular payments to partners for services rendered are called guaranteed payments. According to Tax Code Section 707(c), a guaranteed payment is a fixed payment made by a partnership to a partner for services or use of capital regardless of whether there is partnership income or profits. Partnerships establish guaranteed payments in order to reduce the risk (to some degree) that a partner will spend time performing services and not receive an allocation of profits.

Guaranteed payments are deducted by the partnership as a business expense, in the same way as employee compensation.[4] Guaranteed payments therefore reduce the profits of a partnership. The payment of a guaranteed payment to a partner is not tracked as a distribution in the partner’s capital account. Instead, it is reported as an expense by the partnership and reported as a separate category of income received by the partner on the partner’s K-1.

Valuation Implications When There is No Agreement for Partner Compensation

Business appraisers typically impute a market level of owner compensation into the expenses of a business in order to determine the fair market value of the business. How should a business appraiser treat the issue of owner compensation where the partnership does not have a compensation agreement in place and does not pay compensation to the partners, but instead distributes a share of partnership profits in exchange for services rendered?

The correct answer depends on the legal context of the valuation and standard of value applicable to the valuation.

For example, if the legal context and standard of value requires a Fair Market Value analysis[5], the appraiser should make a valuation adjustment to impute hypothetical market level compensation for services provided by the owners. This is due to the fact that a hypothetical buyer would not be presumed to maintain the partnership ownership structure, and may instead incorporate the business operation. As a result, a hypothetical buyer would assume that market compensation must be paid to all individuals providing services to the business.

However, if a legal claim provides for some other measure of value that does not assume a hypothetical buyer and seller[6], and no compensation had been paid or compensation agreement had been in place, an argument could be made that profits and corresponding value should be determined without imputing partner compensation. Whether or not this treatment would be appropriate depends a on the legal claims giving rise to a dispute and the facts and circumstances of the case.

Valuation Implications for Professional Service Partnerships with Compensation Agreements

I have appraised many professional service partnerships and Limited Liability Companies for the purpose of helping a partner or the entity facilitate a buy-in or buy-out of a partner. One question that frequently arises is whether a valuation adjustment should be made to impute a market level of compensation to the business for purposes of determining the value of a minority partner’s ownership rights, when compensation levels and profit sharing formulas are governed by contracts among the partners.

When valuing a minority partner’s ownership rights, it is important to consider that the minority partner would not be able to compel the partnership to change the compensation contracts or sell the business. Therefore, for valuation purposes, a valuation adjustment for market compensation would not apply to a fair market value determination for a minority partner interest.

Please email me at [email protected] with any feedback or suggestions for topic areas that you think I should cover in this series.

Serena Morones, CPA, ASA, ABV, CFE

[1] Revised Uniform Partnership Act, Section 401 (h).

[2] Ibid.

[3] Refer to my previous article, Financial Resolution of Partnership Disputes Article 2: Partnership Accounting with Capital Accounts to understand the importance of capital accounts to the final financial resolution of a partnership dispute.

[4] However, employer payroll taxes are not paid on guaranteed payments. Partners pay self-employment taxes on income received as guaranteed payments.

[5] ACIPA Statement on Standards for Valuation Services N. 1 defines Fair Market Value as “the price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arms length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.”

[6] Such as statutory Fair Value, Strategic Value, or a claim for lost profits.

Read Article Four: Identifying and Adjusting Personal Expenses