Peering into the Crystal Ball of College Sports:

A Convergence of the New CFP and the House v NCAA Antitrust Case

By Serena Morones, CPA, ASA, ABV, CFE, Paul Heidt, CPA, ASA, ABV and Kori Bogard, CPA, CFE, CFF

As we navigate the intricate financial landscape of college sports, we find ourselves peering into the future, envisioning forthcoming shifts in cash flow dynamics. Our previous article, Following the Money in College Sports, detailed how college sports are currently undergoing a monumental transformation driven by catalysts such as conference realignment, increasing TV contract dollars, new Name Image and Likeness (NIL) agreements, the expansion of the college football playoffs (CFP), and a surge in litigation challenging the traditional concept of amateurism. When we dissected these transformative factors, two significant drivers emerged, that we dive into in this new piece, which are poised to reshape the industry by both generating substantial new revenue and incurring significant costs. We predict that these two drivers will converge to force college sports into a tiered system, harnessing increased CFP funds to compensate college athletes and elevate the CFP entity to a dominant power structure.

Significant Driver #1: Expanded College Football Playoffs

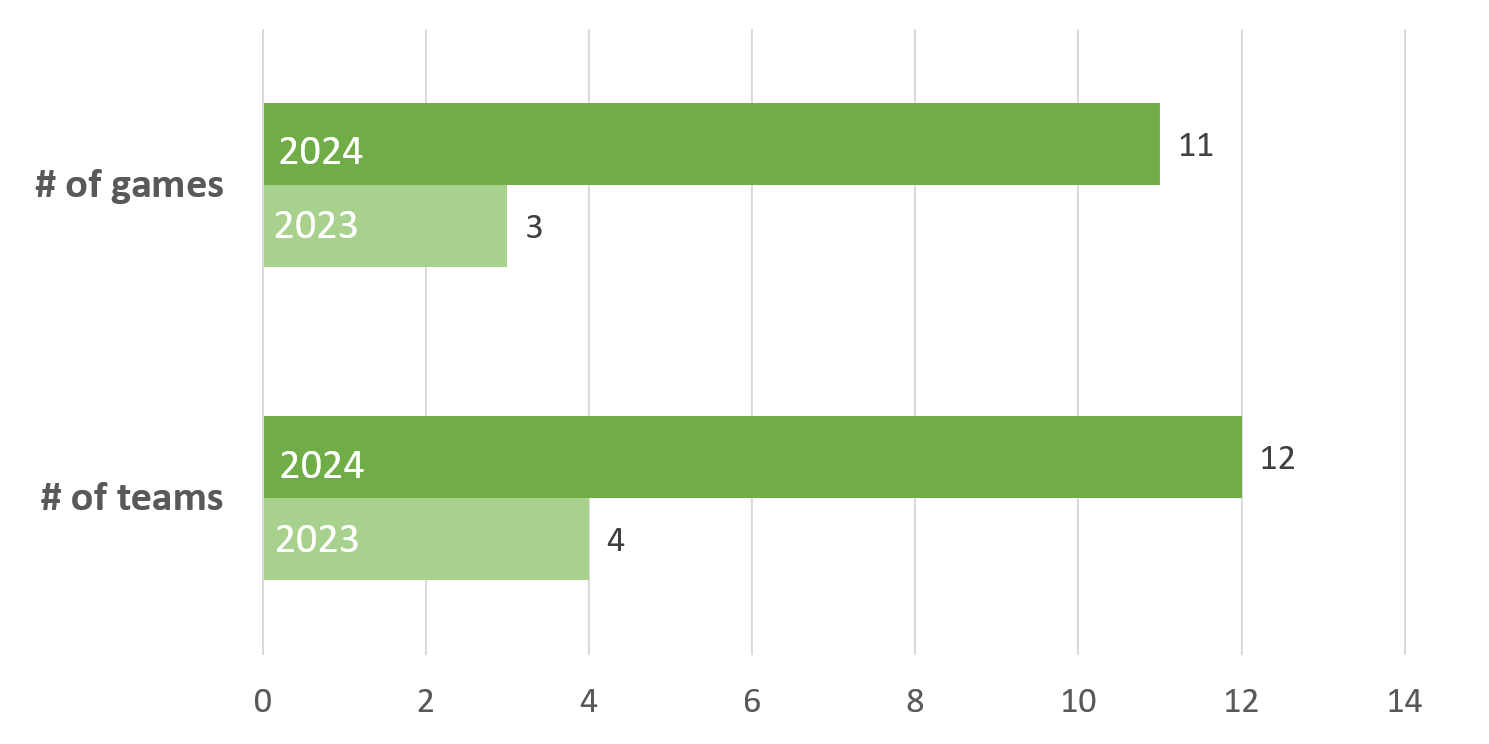

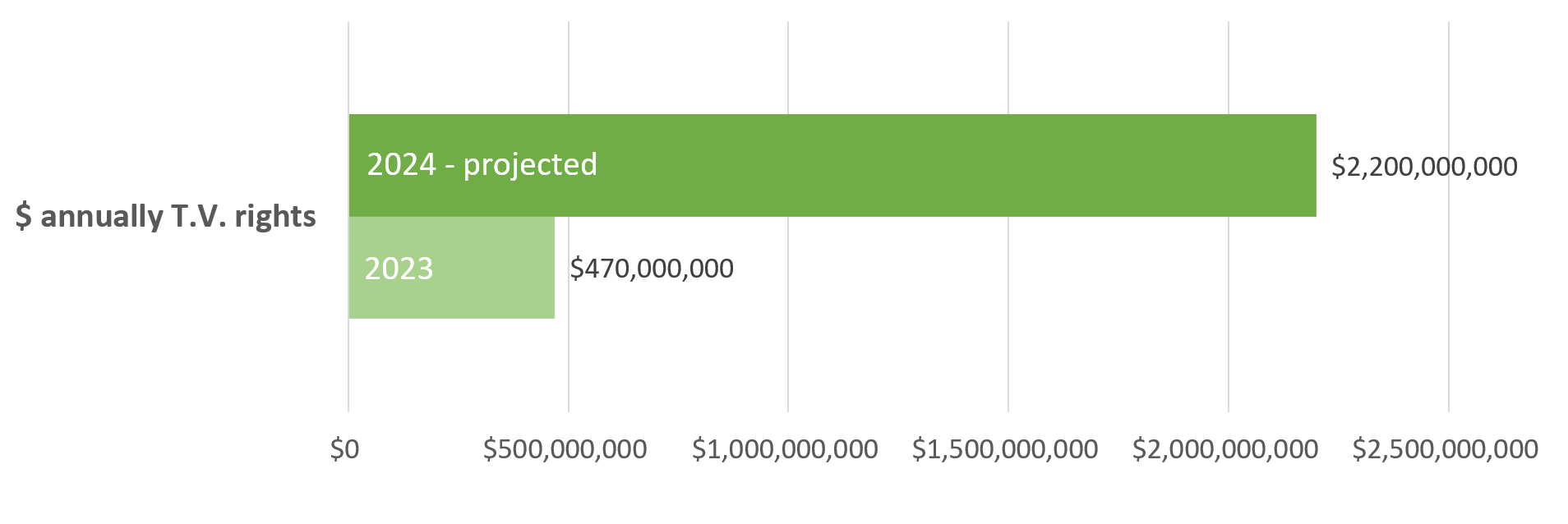

The college football postseason, inclusive of bowl games and the CFP, infuses substantial revenue into athletic conferences and schools through lucrative television broadcast rights deals. In the 2022-2023 season, there were a total of 43 postseason bowl games, including the three-game CFP, with conference payouts ranging from $225,000 for less prestigious bowls to nearly $100 million for inclusion in the CFP.[1] However, in 2024, the CFP will undergo a significant expansion, transitioning from four teams and three games to twelve teams and eleven games. Early estimates project television rights for this 11-game football tournament at a staggering $2.2 billion annually, a remarkable increase from the estimated $470 million generated by the current three-game system.[2] [3]

The current CFP structure provides each Power 5 conference with approximately $103 million per year, but with the expanded 12-team CFP, this figure is anticipated to rise to approximately $323 million annually.[4] This substantial boost in CFP revenue (an estimated $1.7 billion in additional annual funds previously unallocated to college coaching salaries and facilities), is expected to cause CFP revenues at $2.2 billion to surpass the NCAA’s current annual revenue generation of approximately $1.2 billion. Given the magnitude of this new revenue stream, we believe the CFP could wield significant influence over the whole college sports ecosystem, likely surpassing that of the NCAA or any single conference.

So, who exactly is the CFP? The CFP is a Texas-based limited liability company known as CFP Administration LLC, owned by the ten Football Bowl Subdivision (FBS) conferences (American Athletic, Atlantic Coast, Big Ten, Big 12, Conference USA, Mid-American, Mountain West, Pac-12, Southeastern, and Sun Belt), as well as the University of Notre Dame.[5] In essence, the CFP is a consortium of conferences that have united to oversee and control the college football playoffs.

The CFP is governed by a board of eleven university presidents and chancellors. A Management Committee[6] consisting of conference commissioners supervises the Executive Director, who handles day-to-day operations, including negotiating TV contracts and the logistics of the Bowl games. The CFP will undergo a significant leadership change in 2025 as long-time Executive Director Bill Hancock announced he will not seek a renewal of his contract.[7] Mr. Hancock was the CFP’s first employee in 2012 after leading the NCAA’s Men’s Final Four for many years. He led the CFP’s drive to the newly expanded playoff system and its meteoric rise in revenues. Only time will tell if Mr. Hancock’s replacement can impactfully lead the CFP with its new financial influence, through a highly fluid era of college sports.

It’s crucial to note that the CFP represents a unification of powerful football conferences and schools that collectively generate the most revenue in college sports.

Significant Driver #2: Litigation Challenging Amateurism

Simultaneously, as CFP revenues soar, a wave of lawsuits are challenging the traditional amateurism model and demanding compensation for college athletes. The most prominent case is House v. NCAA, an antitrust lawsuit against the NCAA and Power 5 conferences. The House case seeks potential payouts of up to $3 billion in retroactive NIL and broadcasting revenue share payments while also aiming to eliminate the NCAA’s existing NIL regulations, opening the door for direct athlete compensation.[8] While we cannot offer an opinion on the merits of the House case, we note that many industry analysts assume the House case will force major change towards athlete compensation.[9]

Convergence of New Revenues and Athlete Compensation Litigation

The surge in revenue from new conference television deals and the expanded CFP has fueled a compelling argument for compensating student-athletes. The college sports industry faces two significant financial obligations: settling the House case and providing annual athlete compensation that substantially surpasses historical levels. While the House case’s damages are estimated at $3 billion, the actual settlement cost could be lower. If industry leaders could settle the House case for $1 billion, this cost could theoretically be covered in a single season by the top-tier schools that are the beneficiaries of the additional $1.7 billion in annual expanded CFP revenue.

However, it’s important to note that settling the House case is a one-time expense. The ongoing cost of athlete compensation remains a question. Enter the Baker Proposal.

The Baker Proposal

NCAA president Charlie Baker introduced a proposal in December 2023 to establish a new subdivision within Division I, granting select schools greater autonomy in policy-making and the ability to compensate athletes.[10] This new subdivision, casually referred to as “Division Zero,” would require member schools to meet a stringent minimum annual compensation threshold (proposed at $30,000 per athlete) and allow them to negotiate direct NIL agreements with their athletes, bypassing traditional NIL collectives. Currently, 80% of NIL income flows through these collectives, which are typically loosely affiliated nonprofit entities associated with a school.[11] Under Baker’s plan, NIL controlled by schools would adhere to Title IX requirements, ensuring that at least 50% of the funds go to women athletes.

These Division Zero schools would remain under the NCAA umbrella and continue competing for NCAA championships with other Division I institutions. However, the schools would gain control over scholarship limits and the number of coaches. It’s important to note that Baker’s proposal was only the first proposal to address formal athlete compensation, and the industry could see alternate proposals offered by the influential CFP or significant modification of the Baker proposal at the request of industry influencers.

We note that the Baker proposal does not appear to suggest how the Division Zero schools will interface with conferences and offers no suggested solutions to address conference re-alignment or offer a method of balancing the financial clout of the richest conferences. The NCAA’s silence on conference re-alignment does not surprise us however, given that the NCAA lacks financial or rule-making influence over the conferences as discussed in our prior article.

The Cost of the Baker Proposal to the Industry

Using Baker’s proposed framework, it would cost an estimated $5.1 million annually for a football program to allocate enough funds to meet the Title IX requirements for each scholarship athlete. Similarly, a men’s college basketball program would require $780,000 annually to comply with the proposed subdivision’s compensation standards. We examined 107 college athletic programs with financial data available.[12] Baker’s plan amounts to compensation costs equaling roughly 13% of an average football program’s revenues, and 8% for men’s basketball. This amount would be in addition to previous scholarship benefit levels offered. If all 107 college athletic programs participated, the estimated industry cost for the two sports would approximate $630 million per year. However, if only the programs with sufficient net profit (Division Zero schools) participated, approximately 52 football programs and 48 men’s basketball programs could be involved, resulting in an annual cost of $300 million.

The college sports industry could theoretically afford to pay the base cost increase of the Baker proposal of $300 million to $630 million per year, (not including an unknown amount of additional school level NIL payments), out of new CFP expansion funds if industry leaders act quickly to restrict use of money for other purposes.[13]

The Baker Proposal Viewed as TV Rights Revenue Share

Additional athlete compensation levels of the Baker proposal, stated as a percentage of TV rights revenue would range from 5% of TV revenues if only Division Zero schools participate to 10% if all schools participate[14]. This new athlete compensation would represent a significant shift in college sports towards compensating athletes.

Implications of “The Great Divide”

A clear division will emerge between schools that can afford to compensate athletes and fund NIL deals and those that cannot, leading to what many analysts refer to as “The Great Divide.”

This extends beyond mere qualification for Division Zero. Using the 2021-2022 football season as an example, the University of Texas generated a staggering $110 million in profit from football, hypothetically allowing for NIL payments averaging around $652,000 per football player.[15] In contrast, the 26th most profitable program, Iowa State University, could hypothetically offer around $159,000 per player, while Virginia Tech University, the least profitable program capable of qualifying, might only afford to pay $41,000 per player. Historically, profits from football and basketball have subsidized other sports within athletic departments. Without additional industry revenue to cover the costs of athlete base compensation and NIL, lesser-funded sports programs at Division Zero schools may be eliminated or face significant challenges.

Our Predictions for the Post-Conversion Landscape

We predict that the increased revenue from enhanced conference TV deals and the additional $1.7 billion from the expanded CFP will serve to both settle the House v. NCAA case and create new revenue streams for the most competitive schools to compensate athletes. Given that the CFP represents a collective of FBS conferences and wields the largest single source of revenue, we anticipate that the CFP entity will become the most influential entity in college sports, (assuming its leadership transition goes well) leading the charge towards a paid athlete system.

————————————————

[1] “College Football Playoff Payouts 2022-2023,” Business of College Sports, November 23, 2022.

[2] “Expanded CFP Could Fetch $2.2B In Annual Media Rights Fees,” Michael McCarthy and Amanda Christovich, Front Office Sports, September 6, 2022.

[3] “Playoff composition, revenue sharing, NCAA influence up for grabs as college football’s power structure shifts,” Dennis Dodd, CBS Sports, August 11, 2023.

[4] “How Much Money Can An Expanded College Football Playoff Generate?” Athletic Director U.

[5] “CFP Governance,” College Football Playoff.

[6] “CFP Overview,” College Football Playoff.

[7] CFP Executive Director Hancock Announces Plans to Retire in 2025, collegefootballplayoff.com

[8] “Is college athletics headed for The Great Split? ‘We need to recreate or relaunch the NCAA,” Ross Dellenger, Yahoo! Sports, November 21, 2023.

[9] Thomas Baker, “Why the NCAA Should Settle Claims in House v. NCAA,” Forbes, November 20, 2023

[10] “NCAA proposing new college athletics subdivision rooted in direct athlete compensation,” Ross Dellenger, Yahoo! Sports, December 5, 2023.

[11] “How NIL deals and brand sponsorships are helping college athletes make money,” Business Insider.

[12] “College Athletics Departments Financial Database,” Sportico.

[13] The Knight Commission, a group of mostly former and current college athletic administrators promoting educational reforms in college sports, is “encouraging CFP leaders to place restrictions on how that distributed money can be used by schools, such as tethering it to educational purposes and athlete health and well-being, as well as regulating excessive coaching salaries through earmarks,” per Dellenger’s November 21, 2023, article.

[14] Estimated TV rights calculated as 2022 TV rights revenues (”Following the Money in College Sports”) of $2.2B + Projected from CFB Playoff of $2.2B – Current CFB Playoff of $470M = $5.93B.

[15] “College Athletics Departments Financial Database,” Sportico.

————————————————————-

See our article published in the Portland Business Journal on 11/17/2023:

Opinion: Following the money in college sports and the Pac-12 shakeup

Authors

Serena Morones, CPA, ASA, ABV, CFE

[email protected]

Paul Heidt, CPA, ASA, ABV

[email protected]

Kori Bogard, CPA, CFE, CFF

[email protected]