Using Comparable Businesses to Value Your Own Company

By Paul Heidt, ASA

The Basics of the Guideline Transaction Method

Just as real estate appraisers use comparable houses in a neighborhood to develop a market price for a home, business appraisers use transactions of comparable businesses to determine company value. This approach to valuing a business is known as the Market Approach—Guideline Transaction Method.

Business appraisers use three main approaches to valuing businesses: the Asset, Income, and Market Approaches. While all three approaches are widely used in business valuation, this article will focus on the Guideline Transaction Method.

Market Approach Overview

The theory of a Market Approach is based on the economic principle of substitution: A person would not pay more than they would have to pay for an equally desirable substitute.[1] Therefore, appraisers look for transactions and the prices paid for businesses that are comparable to the subject business.

The Guideline Transaction Method uses actual sales of businesses to develop indications of value. Appraisers should believe that the sale prices were derived on an arm’s length basis, which assumes the buyer and seller were acting in their own best interests.

Market Multiples

The Guideline Transaction Method uses market multiples,[2] which are factors by which appraisers multiply a financial measure to arrive at an indication of value. A market multiple results from dividing the sale price (the numerator) by a financial measure of the company (the denominator). The most familiar market multiple is the Price-to-Earnings (P/E) multiple, but other multiples commonly used in business appraisal are Price-to-Revenue, Price-to-EBITDA (earnings before interest, taxes, depreciation and amortization), or for smaller companies, Price-to-SDE (seller’s discretionary earnings).[3] As the name implies, the market multiples are derived from the market, from arm’s length sales of businesses.

Appraisers compute market multiples are applied then to the same financial measure of the subject company to arrive at an indication of value.

Other Market Approach Methods

Other Market Approach Methods include the Guideline Public Company Method, the Industry Method, often referred to as “rules of thumb,” and the Prior Transaction Method.

The Guideline Public Company Method uses pricing multiples of comparable public companies whose stock trades freely in the public market. While the public companies will not be identical to the subject company, they should be similar enough to provide valuation guidance to the appraiser. Given the size of most public companies, the Guideline Public Company Method is generally used to value larger companies.

Another method of the Market Approach is the use of the Industry Method or “rules of thumb.” An example of a broad rule of thumb is that restaurants typically sell at a price of 25% to 40% of annual gross sales. Other Market Approach methods appraisers consider when determining company value include the analysis of past transactions involving the subject company and offers to purchase the subject company.

Sources of Public and Private Company Transactions

Data sources for public company transactions are readily available and includes the Securities and Exchange Commission (“SEC”) website. A prospectus must be filed through the SEC if a public company is acquired, which provides details of the sale. Information about a public company transaction is also likely to be found in the financial press.

Appraisers look to subscription-based databases to obtain private company transaction data. The transactional databases acquire information from SEC filings in which public companies buy private companies and must disclose financial details or through business brokers, who are frequently involved in many transactions.

Examples of private company transaction databases include Bizcomps®, Done Deals, the IBA Market Data Base, and Pratt’s Stats®. The Bizcomps® database, for example, contains over 12,800 private transactions occurring since 2000, while Pratt’s Stats® has financial information on over 27,000 acquired closely-held businesses. Each transaction in the databases is classified by their industry or practice group through hundreds of Standard Industrial Classification (“SIC”) or North American Industrial Classification System (“NAICS”) codes.

While often the financial details or pricing terms of a private company transaction is not disclosed, one may find limited details about the transaction in newspaper or online articles or from company press releases. While an appraiser may only be able to calculate a Price-to-Revenue multiple from the article or press release, it may nevertheless prove useful in determining a market multiple for a company in a given industry.

Beyond using subscription databases, sale prices of private companies may be found from public company SEC disclosures. If a public company acquires a company, and the transaction is material to the financial statements, the public company will disclose acquisition details in a form 8-K SEC filing.

Productivity Capacity Measures

Productive capacity can also serve as an indication of value. We have developed multiples of productivity capacity in our valuations and used these multiples alongside traditional financial multiples. Measures of productive capacity have included Price-to-Annual Board Feet (sawmills), Price-to-Cases Produced (wineries), and Price-to-Beds (assisted living facilities).

Guideline Transaction Method Example

In order to demonstrate the theory and application of the Guideline Transaction Method, we will calculate the value of ABC Pizza, a hypothetical pizza restaurant with sales of $1 million and seller’s discretionary earnings (“SDE”) of $250,000. For our purposes, we will also assume that ABC Pizza had current assets, excluding inventory, of $75,000 and total liabilities $100,000 at the valuation date.

Searching for Guideline Transactions

As discussed above, the best source of data for a small pizza restaurant consists of subscription-based databases of small to middle-market private transactions. While we would search all of the available databases, for purposes of our analysis, we will limit our transaction searches to the Pratt’s Stats database.

To find guideline transactions for ABC Pizza, we began a broad search of the Pratt’s Stats database by searching by the SIC code 5812, the code for restaurants. Our initial research resulted in nearly 3,000 transactions of restaurants dating back to 1991. Appraisers prefer to use transactions as close to the valuation date and as comparable by business description or size to the subject company as possible. And we should consider the differences in economic and industry conditions in determining how far back to include transactions in their analysis.

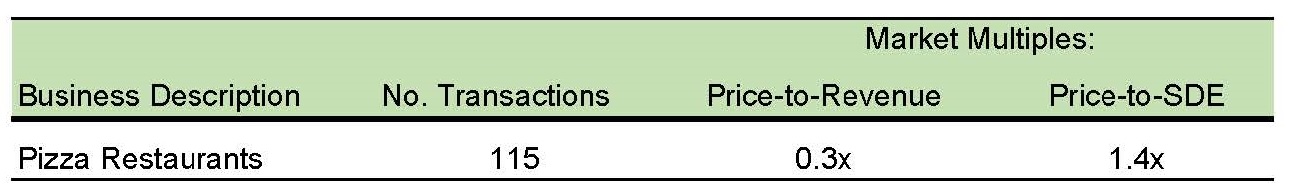

In this case, we narrowed our Pratt’s Stats search criteria to only include transactions of pizza restaurants that occurred in the five years prior to the valuation date. Now we find 115 asset sale transactions of closely-held pizza restaurants sold in the five years prior to the valuation date with a median Price-to-Revenue multiple of 0.3x and a Price-to-SDE multiple of 1.4x.

For many small companies, such as a pizza restaurant, the revenue and SDE figures are the only operating financial figures available, so we developed multiples of Price-to-Revenue and Price-to-SDE.

Application of the Market Multiples

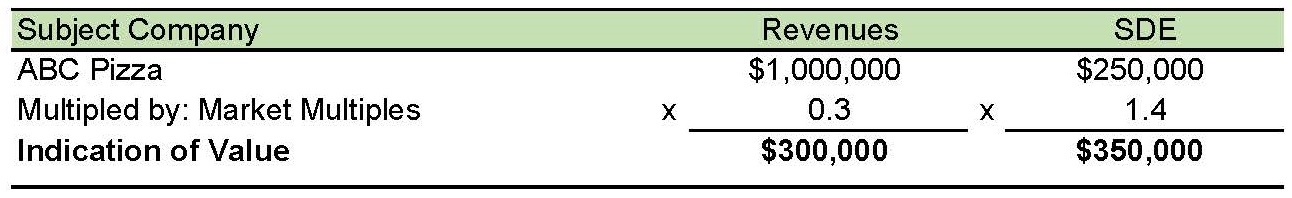

After calculating market multiples, we apply the median market multiples to our subject company’s revenue and SDE for the past year, as shown below:

Our analysis resulted in indications of value of $300,000 for the Price-to-Revenue multiple and $350,000 for the Price-to-SDE multiple.

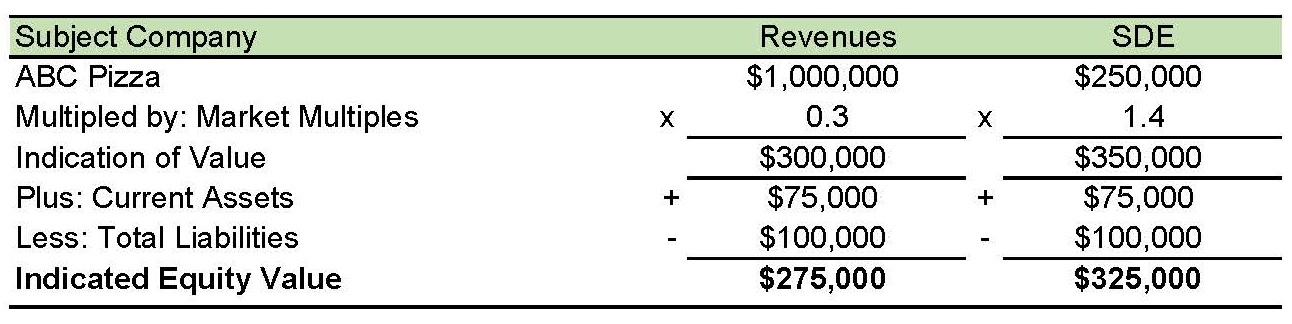

The businesses in our data set were sold in the form of an asset sale (as opposed to stock sales), in which only certain assets, usually the operating assets, such as inventory and machinery and equipment are transferred to the buyer. After calculating value derived from the market multiples, we adjust for any of the subject company’s assets or liabilities not included in the guideline transactions.

In this case, we add the company’s current assets, excluding inventory since it is already included in the Pratt’s Stats’ sale price, and subtract the total liabilities from each indication of value as shown below:

Conclusion of Value

The final step in the Guideline Transaction Method requires a review and weighting of each indication of value to reach a final value conclusion. The Price-to-Revenue multiple may receive the most weight for many small companies, especially service companies, as it is often the most available. Since many financial results, such as net income, may be negative for very small companies like a pizza restaurant, the next most commonly-used market multiple is Price-to-SDE.

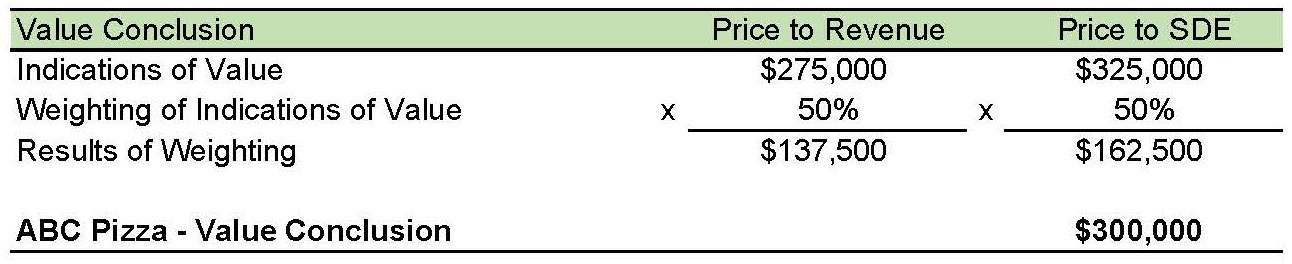

In this case, we weighted the Price-to-Revenue and Price-to-SDE indications of value equally, as shown below:

This resulted in a value conclusion of $300,000 for a 100% controlling interest in ABC Pizza under the Guideline Transaction Method. If we were determining the Fair Market Value of a minority interest in ABC Pizza, we would typically consider discounts for lack of control and lack of marketability as the next step in the analysis.

As a reasonableness test or “sanity check,” we considered that in our experience, a broad rule of thumb for a restaurant is that they typically sell at a price of 25% to 40% of annual gross sales. Our value conclusion of the pizza restaurant falls within the industry rule of thumb.

Paul Heidt, ASA is the Director of Valuation Research for Morones Analytics. He has substantial experience in the collection and analysis of business acquisition data, working previously for Business Valuation Research and also serving with Morones Analytics.

To learn more about your company value or about the other services Morones Analytics offers, please contact Paul Heidt, ASA at 503-906-1583 or [email protected].

We were provided permission by Business Valuation Resources, LLC to use the presented Pratt’s Stats information in this article.

References for this article include “The Market Approach to Valuing Businesses,” Shannon P. Pratt, John Wiley and Sons, 2001, “Understanding Business Valuation, 2nd ed.” Gary R. Trugman, AICPA, 2002, and “Financial Valuation: Applications and Models,” James R. Hitchner, John Wiley and Sons, 2006.

[1] “The Market Approach to Valuing Businesses,” Shannon P. Pratt, John Wiley & Sons, Inc., 2001.

[2] Also referred to as valuation multiples or pricing multiples.

[3] Per the Pratt’s Stats FAQ page at BVMarketdata.com, seller’s discretionary earnings are defined as operating profit plus owner’s compensation plus depreciation and amortization