Which Valuation Approach is Best for a Manufacturing Company?

An owner of a local manufacturer is hoping to sell the company in the future, but is unsure of its value and is hesitant to seek out potential buyers before having the company appraised. The company has steady revenues and generates only a very slight profit, but the owner wonders if a potential buyer of the manufacturing company would consider the substantial amount of working capital, manufacturing equipment, and real estate on the Company’s balance sheet.

With the asset-intensive nature of this manufacturing company, how would a business appraiser typically go about valuing the manufacturing company? In this case, the most appropriate approach may be the Asset Approach, which restates the value of assets and liabilities from their historical cost to fair market value. Of course, what approach will be best in a given valuation will depend on the facts and circumstances of each case.

Business appraisers use three primary approaches to value businesses: Income, Market, and Asset Approaches. The Income Approach converts expected future cash flows to a present value, while the Market Approach uses actual sales of businesses or actual market prices to develop indications of value.

While all three approaches would need to be considered in a business valuation, this article focuses on the theory and application of the Asset Approach and will present an example of valuing the previously-described manufacturing company using the Asset Approach.

Asset Approach Overview

In the Asset Approach, also commonly referred to as the “Cost Approach,” business appraisers estimate equity value by restating the value of assets and liabilities from historical cost to fair market value. The term “fair market value” is defined as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.[1]

The Asset Approach adjusts a company’s net book value to its fair market value.[2] The book value of a company is the historical cost of all the company’s assets less the total accumulated depreciation. Net book value is the book value of the company’s assets less the recorded liabilities. The fair market value of the company will likely be higher or lower than the company’s net book value.

There are three methods under the Asset Approach: Adjusted Book Value Method, Liquidation Value Method, and the Cost to Create Method.[3]

The Adjusted Book Value Method is primarily used in the appraisal of an asset-intensive business, such as the manufacturing company described in the introduction. When valuing a company using the Adjusted Book Value Method, we start with a book value basis balance sheet as of the valuation date. Next, we restate the assets and liabilities, including those that are unrecorded, to their fair market value. After the assets and liabilities have been adjusted to fair market value, we subtract the liabilities from the assets to arrive at the company’s net asset value.

The Liquidation Value Method under the Asset Approach can be used when an actual liquidation of the business is contemplated or when the highest and best use of a property is to liquidate. Liquidation value is defined as the net amount that would be realized if the business was terminated, and the assets were sold individually.[4] Liquidation value is computed as the fair market value of assets, net of liabilities, less estimated liquidation costs. Liquidation costs may include commissions, administrative costs, legal and accounting expenses, and taxes on the disposal of assets as a result of the liquidation. An appraiser would not likely use the Liquidation Value Method to value the previously-described manufacturing company as the owner has no immediate plans to liquidate.

The Cost to Create Method is similar to the Adjusted Book Value Method, but in addition to valuing the net tangible assets, the appraiser also values the intangible assets, such as customer lists. This method requires the appraiser to estimate how much it would cost to recreate the enterprise being valued. This would include trying to estimate the time, effort, and monetary contribution necessary to recreate the intangible assets of the business.

Appropriateness of the Asset Approach in Practice

Business appraisers commonly-use the Asset Approach for asset-intensive businesses, such as not-for-profit organizations, manufacturing companies, and real estate holding companies. For asset-intensive businesses, such as the previously-discussed manufacturing company, the value of the tangible assets will explain most, if not all the value, while the value of intangible assets, such as goodwill, will likely not be an important factor in determining the total value. Tangible assets are physical assets, such as cash, accounts receivable, inventory, property, plant, and equipment. Intangible assets are non-physical assets, such as franchises, trademarks, patents, copyrights, etc. that grant rights and privileges and have value for the owner, while goodwill arises as a result of name, reputation, customer loyalty, location, or products.[5]

Conversely, business appraisers generally do not use the Asset Approach for service-type businesses or companies with few assets, as most of the value of such businesses is derived from the value of their intangible assets. Also, the Asset Approach is generally considered less appropriate to value operating companies with significant intangible assets. An operating company’s value is generally based on their ability to generate earnings and cash flow and are best valued under the Income or Market Approaches. The Asset Approach would also not likely be used to value minority interests, as the minority owner has no control over the sale of assets.[6]

Valuing Assets and Liabilities

In the context of the Asset Approach, we adjust each asset and liability from its balance sheet book value to its fair market value. Below, we present examples of assets and liabilities and how business appraisers typically value them under the Asset Approach:

- Cash typically does not require an adjustment from its book value. If the available balance sheet is as of a date different from the valuation date, the appraiser may ask for a bank statement as of the valuation date to confirm the cash balance.

- Accounts receivable should be reviewed for collectability. A company’s allowance for doubtful accounts should be reasonable and an appraiser may want to review a company’s accounts receivable aging report, in order to make any potential adjustments.

- Inventory should be adjusted to fair market value, which would typically be at the lower of cost or market. This means that inventory price increases during the period inventory is held for sale are ignored, but price declines are recognized. An appraiser may accept inventory at book value if the client believes the amount approximates fair market value, but the appraiser will want to investigate whether there is obsolete inventory included in the book value of inventory and remove that amount.[7]

- Loan to shareholders may be on the balance sheet as the company may have loaned money to its shareholders. If the shareholders have no intention to pay the loan back and the company does not have any intention to collect on the loan, then the fair market value of the asset would be zero.

- Land and buildings should be appraised at fair market value. A real estate appraiser usually performs the task of determining the fair market value of the land or buildings.

- Machinery and equipment should also be appraised at fair market value. This may be done by a machinery and equipment appraiser or the value may be estimated by the appraiser using the company’s depreciation schedule. Unless the amounts are immaterial, it is usually not advisable to use book values as proxies for fair market value.[8]

- Identified intangible assets often arise from organization costs or acquisition-related intangible assets. Capitalized historic expenditures for services typically have no value and are written off, while intangible assets representing historical payments may need to be reviewed and revalued.[9]

- Notes payable may be adjusted if the interest rate on the note is not considered to be a market interest rate.

- Unrecorded Assets and/or Contingent liabilities, which are typically not recorded on a cost-basis balance sheet, should be recognized on the value-based balance sheet and may have a significant effect on the value of the company. While most unrecorded assets are intangible in nature, there can be other types of unrecorded assets, including a pending litigation claim to be paid and assets that have been written off but are still used in the business. Contingent liabilities may include potential environmental liabilities, pending litigation, or income or property tax claims against a company.

Asset Approach Example

In order to better demonstrate the theory and application of the Asset Approach, we will calculate the net asset value of ABC Company, the hypothetical asset-intensive manufacturing company described in the introduction.

Subject Company Balance Sheet

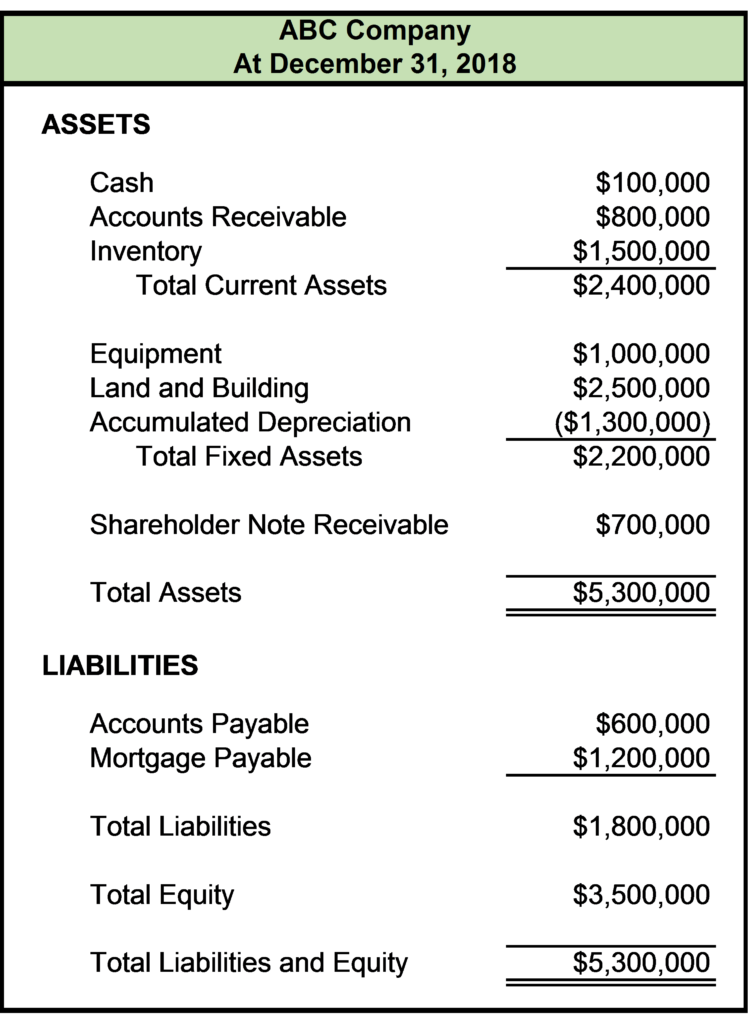

Presented below is ABC Company’s balance sheet at December 31, 2018, which for purposes of our example, will be our valuation date.

As shown above, the Company has current assets, consisting of cash, accounts receivable, and inventory of $2,400,000 and net fixed assets of $2,200,000 at the valuation date. Through December 31, 2018, ABC Company has loaned a total of $700,000 to a shareholder over the last five years.

ABC Company’s liabilities consist of accounts payable of $600,000 and a market-rate mortgage with a balance of $1,200,000 at December 31, 2018. This equates to a book value of equity of $3,500,000 at the valuation date.

Application of the Asset Approach

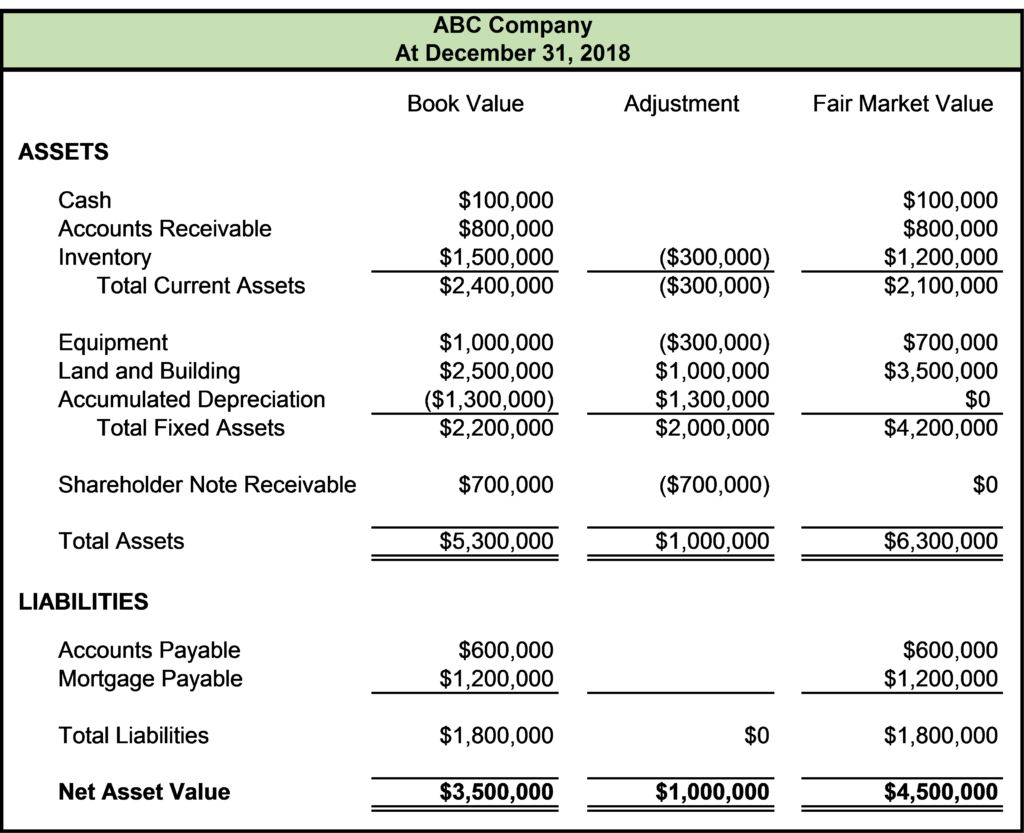

In order to apply the Asset Approach, we adjust the book value of the Company’s assets and liabilities to their fair market value.

We began by first examining ABC Company’s current assets. We determine that the cash balance was equal to that of ABC Company’s bank statement at December 31, 2018 and all the Company’s accounts receivable were reasonably expected to be collected upon based on the Company’s aging report. Therefore, we do not make any adjustment to the Company’s book value of cash or accounts receivable.

After discussions with ABC Company’s management, we determine the Company has $300,000 in obsolete inventory. Therefore, the Company’s value of inventory is reduced by $300,000.

ABC Company has equipment, as well as land and buildings, on its balance sheet at December 31, 2018. These fixed assets were recorded at historical cost and need to be adjusted to fair market value. Since most business appraisers are not trained and accredited to value fixed assets, a machinery and equipment appraiser, as well as a real estate appraiser was retained to value the fixed assets. The machinery and equipment appraiser values the Company’s equipment at $700,000, while the real estate appraiser determines a fair market value of $3,500,000 for ABC Company’s land and buildings. Using the values from the respective appraisers, we remove the accumulated depreciation and set ABC Company’s equipment and land and buildings to their fair market values.

The last asset on the Company’s balance sheet was the $700,000 loan to a shareholder. Since the Company does not intend to collect the loan and the shareholder has no intention of paying off the balance, we conclude the shareholder receivable did not have any value to the Company and adjust the fair market value to zero.

After examining ABC Company’s assets, we must also consider making adjustments to the Company’s liabilities. We determine the Company’s accounts payable was stated at fair market value and the interest rate on the mortgage was at a market rate. Therefore, we do not need to make any adjustments to the book value of ABC Company’s liabilities.

Finally, we inquire about whether ABC Company has any unrecorded assets or liabilities. After discussions with the Company’s management, we determine that ABC Company does not have any unrecorded assets or liabilities and do not need to make any further adjustments to the balance sheet.

Based on our analysis described above, we adjust the Company’s assets and liabilities, which were stated at their balance sheet book value, to their respective fair market values, as shown below:

Conclusion of Value

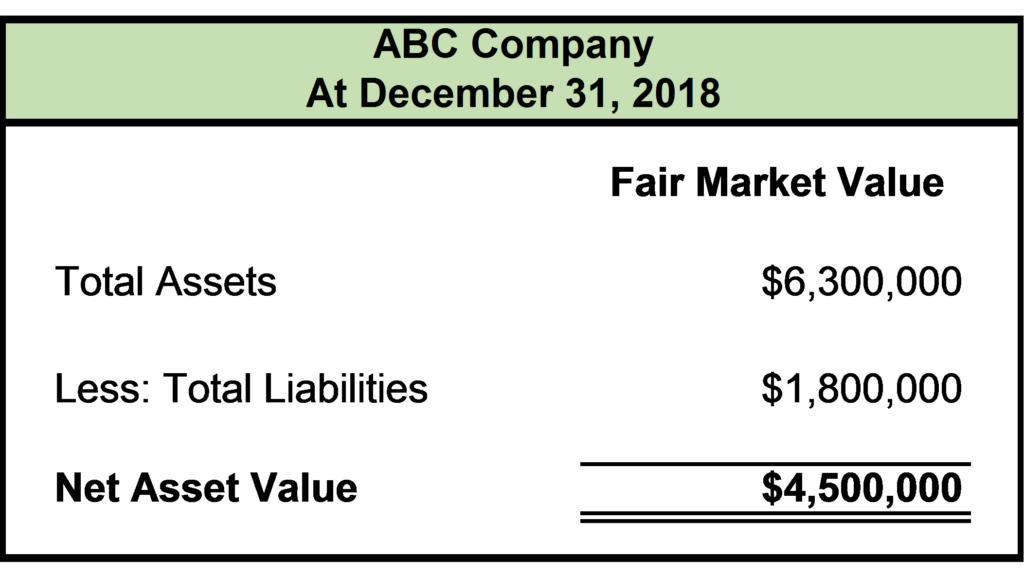

After adjusting the assets and liabilities to fair market value, we subtract the $1,800,000 in liabilities from the $6,300,000 in assets to arrive at ABC Company’s net asset value of $4,500,000 for a 100% controlling interest.

Now armed with the knowledge that his Company has an appraised value of $4,500,000, the owner can use this information to seek out potential buyers and more confidently weigh the different options of selling the business.

Paul Heidt, ASA is the Director of Valuation Research for Morones Analytics. He has substantial experience in using the Asset Approach, as well as the Income and Market Approaches, to value closely-held businesses.

To learn more about potentially valuing your business or about the other services Morones Analytics can offer you, please feel free to contact Paul Heidt, ASA at 503-906-1583 or [email protected].

References for this article include “Valuing a Business: The Analysis and Appraisal of Closely Held Companies, 5th ed.” Shannon P. Pratt with Alina V. Niculita, McGraw Hill, 2008, “Understanding Business Valuation, 2nd ed.” Gary R. Trugman, AICPA, 2002, and “Financial Valuation: Applications and Models, 2nd ed.” James R. Hitchner, John Wiley and Sons, 2006.

[1] Revenue Ruling 59-60.

[2] “Valuing a Business: The Analysis and Appraisal of Closely Held Companies, 5th ed.” Shannon P. Pratt with Alina V. Niculita, McGraw Hill, 2008.

[3] “Understanding Business Valuation, 2nd ed.” Gary R. Trugman, AICPA, 2002.

[4] “BVR’s Glossary of Business Valuation Terms, 2010,” Business Valuation Resources, LLC.

[5] “BVR’s Glossary of Business Valuation Terms, 2010,” Business Valuation Resources, LLC.

[6] “Understanding Business Valuation, 2nd ed.” Gary R. Trugman, AICPA, 2002.

[7] “Financial Valuation: Applications and Models, 2nd ed.” James R. Hitchner, John Wiley and Sons, 2006.

[8] Ibid.

[9] Ibid.