How Appraisers Use Transactions of Similar Businesses to Value a Company

A foundational piece of a business appraisal is the Market Approach. The Market Approach-Guideline Transaction Method uses actual transactions of similar businesses to develop indications of value. Appraisers look for sale transactions and the prices paid for businesses that are comparable to the company they are valuing.

Read on for a brief overview of identifying comparable transactions, market multiples, and the Guideline Transaction Method (“GTM”) with a simple example of its application.

Identifying Comparable Transactions

In each business valuation engagement, appraisers first attempt to find transactions of businesses that are similar to the company they are valuing. While certain types of businesses or industries may not have many transactions, it is important for the appraiser to spend time identifying any transactions that could potentially be used in a Market Approach.

Appraisers typically search subscription-based databases of small to middle-market private or public transactions, such as Deal Stats. We prefer to use transactions as close as possible to the valuation date and comparable to the subject company’s business description or size.

If a very limited number of transactions are found, we may decide not to use the Market Approach in our conclusion of value or to not weigh the Market Approach value conclusion as heavily as the value indications from other valuation approaches.

Market Multiples

The transactions of acquired companies are used to develop market multiples, which are factors by which appraisers multiply a financial measure to arrive at an indication of value. A market multiple results from dividing the sale price (the numerator) by a financial measure of the company (the denominator). Some market multiples commonly used in business appraisal include Price-to-Revenue, Price-to-EBITDA (earnings before interest, taxes, depreciation, and amortization), or for smaller companies, Price-to-SDE (sellers’ discretionary earnings). The market multiple is then applied to the same financial measure of the subject company to arrive at an indication of value.

Application of the GTM

To provide an example of how we would apply the GTM, we will calculate the value of ABC Pizza, a hypothetical pizza restaurant with annual revenue of $1 million and SDE of $250,000. For our purposes, we will also assume that ABC Pizza had current assets of $75,000 and total liabilities of $100,000, as of the valuation date.

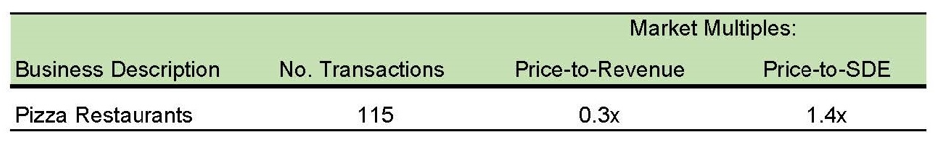

To value ABC Pizza, we searched the Deal Stats database for transactions of pizza restaurants that occurred in the five years prior to the valuation date. Based on our search criteria, we located 115 asset transactions of pizza restaurants and calculated a median Price-to-Revenue multiple of 0.3x and a median Price-to-SDE multiple of 1.4x.

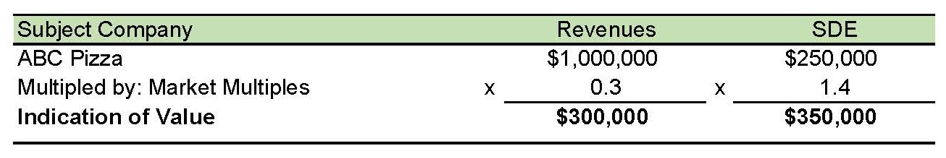

After calculating market multiples, we apply the selected market multiples to our subject company’s revenue and SDE for the past year, as shown below:

Our analysis resulted in indications of value of $300,000 for the Price-to-Revenue multiple and $350,000 for the Price-to-SDE multiple.

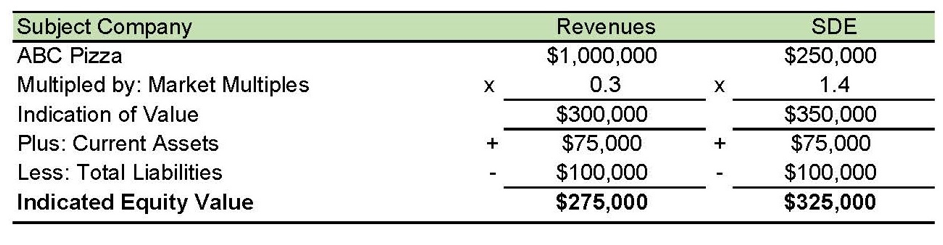

From the indications of value, we adjust for any of the assets or liabilities not typically included in the asset transactions. In this case, we add the subject company’s current assets and subtract the total liabilities from each indication of value as shown below:

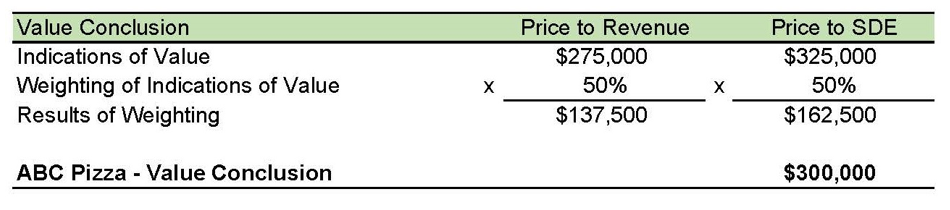

This resulted in equity value indications of $275,000 for the Price-to-Revenue multiple and $325,000 for the Price-to-SDE multiple. Weighting the two equity value indications equally resulted in a value conclusion of $300,000 for ABC Pizza under the GTM.

For a more detailed explanation of the GTM and additional information on the Market Approach, see my piece on Using Comparable Businesses to Value Your Own Company.

We were provided permission by Business Valuation Resources, LLC to use the presented Deal Stats information in this article.

————————————————–

Paul Heidt is the Director of Valuation Research for Morones Analytics. He has substantial experience valuing closely-held businesses for litigation, gift and estate tax planning, marital dissolution, business transactions, reorganizations, and succession planning.

To learn more about potentially valuing your business, contact Paul Heidt at 503-906-1583 or [email protected].